Internal Controls Consulting

Avoid bankruptcy, "Currency Headwinds" and other disasters.. GET CONTROL of your internal controls before they get control of you.

Here is the million dollar (or perhaps billion dollar question)

DO YOU HAVE ADEQUATE INTERNAL CONTROLS?

.. And if not, what can it potentially cost you?

What are Internal Controls? That's the Governance you are supposed to exert on your organization, pertaining to risks that may negatively impact your business. That includes commonly known accounting risks like balance sheet risk, financing risk, but also unknown knowns like FX risk, operational risk, cybersecurity issues, and more. See in the first example how Google lost billions because they forgot (or negligently decided) not to hedge their FX exposure ....

Have you heard the buzz phrase "Currency Headwinds" on news headlines when a publicly traded company loses billions of dollars? It means in legalese "Didn't Hedge FX" ...

This endemic problem is so shocking it's difficult to believe at first. But we're going to provide all the evidence of the problem as well as free tools to help you solve the problem on your own.

FACT: About 50% of publicly traded companies hedge their international Currency risk exposure. That means that about 50% do. A few names that have excellent FX management desks include Intel, Ford, McDonalds, General Electric, and Airbus. Actually, if we include foreign firms the rate of Currency hedging goes much higher; almost all non-US publicly traded companies hedge their Currency risk. Why?

The money center banks have kept a secret from US corporates, investors, and the general public. Foreign Exchange, or FX - is a huge free money generating cash cow for them. During the 2008 financial crisis, during the .com bust, during the real-estate collapse, FX kept their balance sheets above water. In other words, this guaranteed cash stream for them is possible because of the lack of understanding in the general population, so there is no incentive for the banks to educate anyone about hedging their FX risks. To put it plainly, unhedged means you can lose billions, and for every billion dollar loser there is a billion dollar winner, and guess who that winner is? The bank.

In another bizarre example of stupidity gone wild, a Yale graduate working for Morgan Stanley was recently let go after the firm discovered he was hiding a $140 Million FX loss on the Turkish Lira. This was possible due to 'mismarking' which is an internal fraud practice whereby the perpetrator can modify the value of positions manually, on the internal books. Of course, that doesn't change the market value which is the real intrinsic value - so at some point those losses are realized by the firm. Internal Controls Consulting can spot this and stop it. Don't let your firm become victim to the next trading scandal. Many of these situations are mistakes - in other words, it is employee ignorance that creates these problems. They don't receive any compensation for the loss - they conceal it just to keep their job.

Lloyds of London is the largest and most respectable insurance marketplace in the world. Typically Lloyds offers re-insurance, and a place were more than 300 members can interact and transact with each other, insuring billions of dollars worth of insurance around the world, with 50% of their business coming from North America. They have had many scandals over the years, and dedicated a phone to complain about wrongdoings. During a recent audit, it was found this phone system was down for at least 16 months! Now they are being monitored by the Bank of England.

If you think this only applies to private companies, think again. Moreover, public organizations have more liability as far as their fiduciary responsibilities managing public offices and utilizing public funds (from taxpayer money). The city of Flint Michigan has a $370 Million Pension shortfall, not due to market forces, but due to a lack of internal controls (over purchasing cards). Cities simply do not have the resources that private firms have. How many Mayors, state senators, county treasurers, and other government managers used to work on Wall St. ? Perhaps a few, but it seems not enough, as cities lack the oversight capabilities to monitor their internal controls, as proven in the story about Flint (and there are many, many others.) In the case of Flint, their financial woes are exaggerated by a water problem that was costly to fix. In times when the budget is tight, it's an even more compelling reason to monitor your internal controls and make sure there isn't any 'slippage' (money being wasted or spent unwisely).

According to an article by Brian Fox featured on Fortune.com July 2, 2020, only 4% of fraud is caught by external auditors:

For too long, auditors haven’t held themselves as accountable as they should for identifying potential fraud, instead paying out massive settlements for missing the signs and red flags within audits. Looking at the big picture, it’s more than a matter of missing the signs.

Auditors aren’t necessarily looking for fraud and won’t see what they aren’t looking for. The numbers show the extent of this: Only 4% of occupational fraud is discovered by external auditors. Many auditors have shaken the responsibility in finding fraud, claiming the onus is on others or that finding fraud is too difficult, especially if there is collusion involved.

It’s time to step up and assume responsibility. The public looks to the accounting profession to be a watchdog, adept at recognizing and uncovering occupational fraud and protecting investments. If we continue to fail at upholding our duty to the public and investors, there is nothing stopping Congress from stepping in and taking away the profession’s exclusive right to perform external audits.

Register to get your free Greypaper "Take Control of your Internal Controls" by Crediblock.com LLC

Learn the secrets of Wall St. and Silicon Valley - how the Elite protect their companies from disaster using insurance, hedging, and strategy

Enter your name and email below for our free Grey Paper…

“Take Control of your Internal Controls”

We value your privacy, we will not share your data with anyone.

Our consulting service in 3 steps

Analysis, plan, execution

We're not only going to analyze your risks and optimize your organization, we're going to give you the tools to execute.

-

1

First we're going to collect information and analyze your strengths, weaknesses, and risks (both known and unknown)

-

2

Then we're going to develop a plan that will address these risks as well as save you money

-

3

Finally, we're going to give you the tools to implement it, and we'll only stay around as long as necessary to ensure compliance

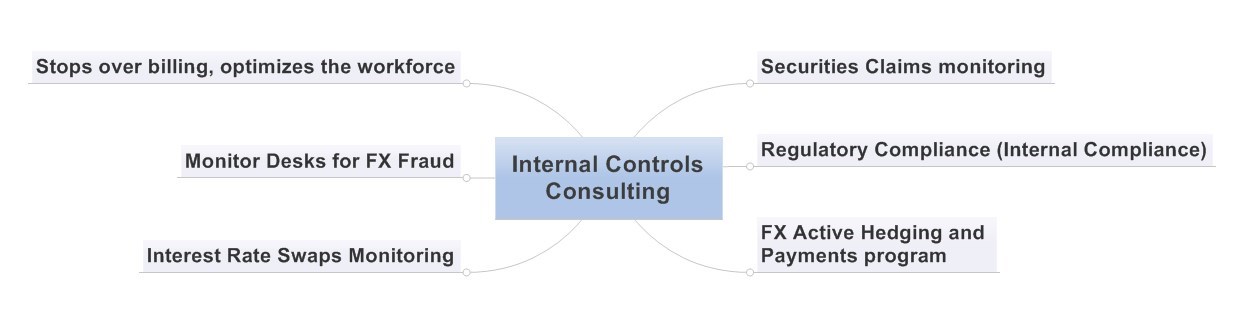

What can Crediblock help with, on Internal Controls?

Beat the Currency Headwinds

The term "Currency Headwinds" is a $1,000,000 word in order to justify an executive forgetting to hedge their currency risk. Why $1 Million? Because that's about what they paid a high end law firm to figure out a branding strategy so the CFO wouldn't get fired. Sometimes the losses from FX risks can be huge. And the strong dollar is bad for exporters,or companies who rely on foreign sales:

...the strengthening US dollar has the potential to hurt big American companies even more than a trade war. Execs have two words for it: “Currency headwinds.” The US Dollar Index, which measures the value of the greenback against a basket of other leading international currencies such as the euro, yen and British pound, has gained nearly 5% this year and is not far from its 52-week high. Why is the dollar so strong? Chalk it up to a healthy US economy – particularly as much of the rest of the world has weakened — and the Federal Reserve’s interest rate hikes. A country’s currency tends to go up in tandem with rates.

But how to beat the Currency Headwinds? It's easy if you know how. 50% of companies hedge their FX exposure. One year in the 1990's Intel Corporation made more profits from FX active hedging positions than they did selling processors. [1]

Stop fraud & overbilling

We have a cloud based tool that can prevent overbilling by contractors. It can also help monitor employees whether on-site or off-site. This technology has been used by companies like Google, Microsoft, and Governments both foreign and domestic.

There is a nominal per user monthly fee but calculating what it can save it is priceless. This could have literally stopped the multi-billion FX fraud. We'll work with your organization on implementation of this wonderful multi-tool.

Cybersecurity

Amazingly, more than 90% of security breaches come from an inside threat. That means, hackers penetrate corporate networks from an employee either with or without their knowledge. Using a cloud based tool we analyze your network and can terminate potential security gaps. The average employee has access to as many as 20 different I.T. systems that may include HR, finance, email, CRM, intranets, and many others. Cybersecurity is about high level secure design, not getting the most expensive firewall on the market. Internal teams are focused on I.T. design and efficiency and thus security is an afterthought. Our certified ethical hackers will look at the network from a security perspective and develop a plan accordingly. Financial firms are required to have Cybersecurity guidelines in the form of operations manual.

We can help with your Cybersecurity compliance - if you are not a regulated financial firm, using the guidelines provided by regulators are solid and stable guides for any type of organization.

Internal Optimization Audit & Analysis

This is typically the job of the I.T. manager, but it's always good to have an independent. We're going to look at your costs, operations, and optimize them. We're not going to tell you how to run your business - we're just going to check if you are wasting money, or if a vendor is bilking you for fees and doing nothing. Our combined backgrounds in law, technology, finance, and trading give us the experience and bandwidth to accomplish this successfully.

Our Pitch - Let our team of experts from diverse backgrounds analyze your operations and help you prevent risks, optimize profits, and prepare for unknown scenarios. Handmade, customized reports delivered right to your boardroom, explained in person.

Enter your name and email below for our free Grey Paper…

“Take Control of your Internal Controls”

We value your privacy, we will not share your data with anyone.