The Pitch

Investors want great returns on their money. The Fed creates inflation and then twists the numbers (for example, by excluding food and energy) claiming that inflation is 1% – 3% which we all know is a lie. But you don’t feel inflation, like the frog in the slowly boiling pot that gets cooked. The stock market usually goes up but returns are capped, indexes can’t really break double digit return barrier. 10% a year is good, 20% is great – 30% is Elite.

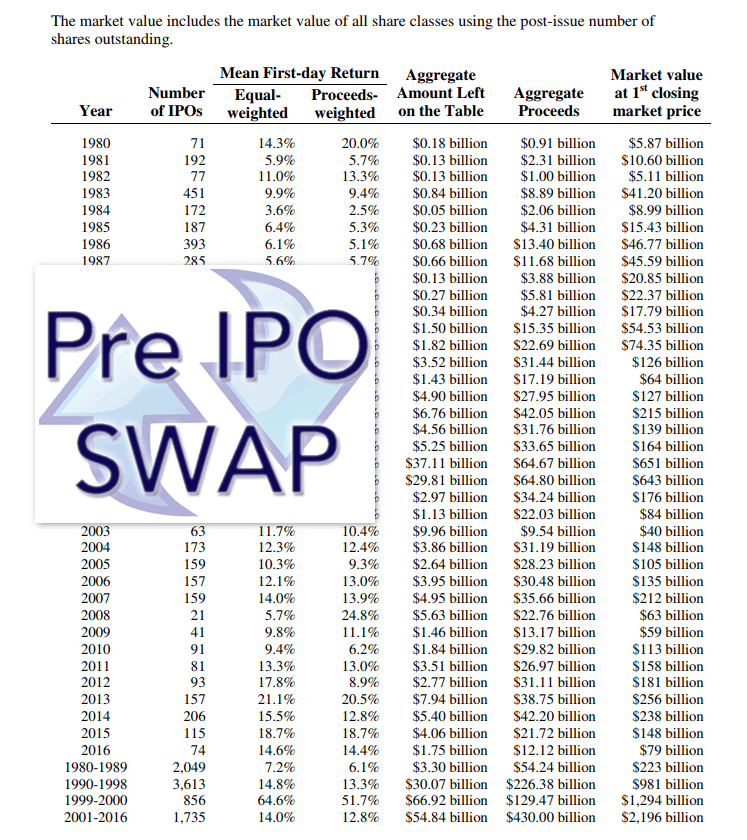

Table of IPO returns in percentage, weighted, and in USD value

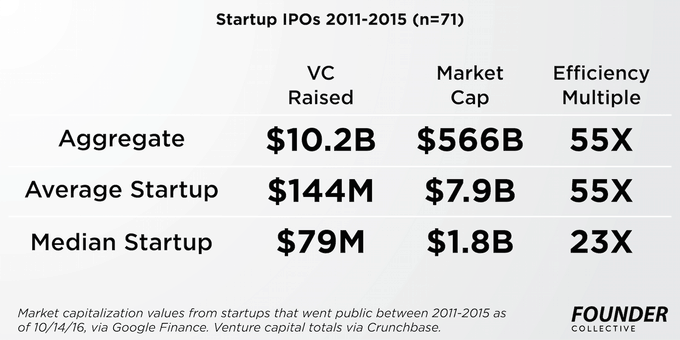

So how to compensate for additional safe return on investment (ROI) ? The answer is Alternative Investments and Pre-IPO Securities. But the problem with Alternative Investments, such as CTA programs and Hedge Funds, they often don’t return much higher than the markets. Certainly they won’t return 1,000% like a Pre-IPO investment might. Where there is high yield there is high risk. But the fact remains that only getting in early on Facebook (FB) and other hot IPOs are the only way to achieve high yield returns. But IPO returns, on average – are good but not great (with an exception from the .com boom but that was an anomaly) – returns vary but you can see mostly double digit numbers with the 2001 – 2016 average being about 12.8% including proceeds weighting. The trick is to get in BEFORE the IPO, which is where you see returns like this:

Read the source article about VC — > IPO equity growth analysis by Tech Crunch.

The solution is to gain access in the ‘sweet spot’ which is AFTER the first few rounds of financing (this is the risky area, where companies can bust) but BEFORE the IPO.

Gain access to late-stage private investments.

That’s what we offer at Pre IPO Swap. Not only that, we have unique and exclusive access to many companies with restricted shares. In addition, we offer the ability to not only buy private stock but to later sell it as well – without a lockup (restrictions such as minimum order size may apply, and possibly other limitations). If you want to re-sell your shares we will make it happen.

Mature, late stage companies with revenues, not startups.

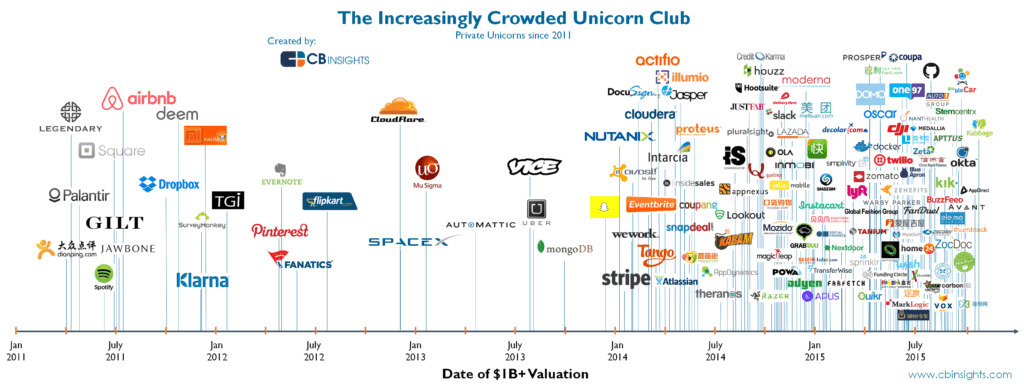

Companies like Space X, Uber, AirBnB; and others – have paved the way for a new generation of “Unicorns”. The IPO market is drying up – but part of that is due to the fact that companies are raising funds privately in the private, Pre-IPO market. Just look at this time chart, how the number of Private offerings has increased. Obviously, everyone wants to recreate the success of Uber, Palantir, AirBnB, and others which have origins dating back before 2013.

Now that the space is so crowded, obviously not all of these deals are going to be 10x – 20x returns. But just like with any high yield investing, that’s where we come in. We don’t have opinions – we have intelligence. We provide market intelligence to our clients – free.

Past Performance of some high fliers Pre IPO investing

There are some other factors to consider. Some companies pay dividends. There are tax consequences on private shares just like on public shares. And many of these returns took many years in order to be realized. Those looking to make a quick buck, should not invest in Pre IPO shares.

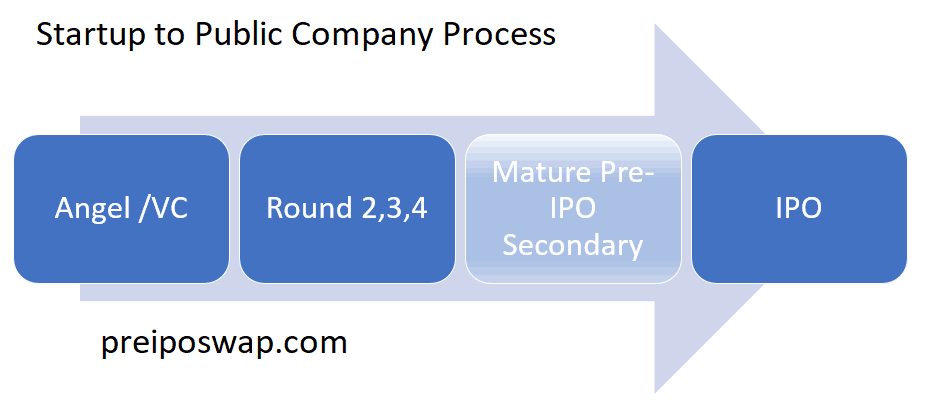

Here is the process for any startup venture:

As time goes on, the risk in investing goes down. That’s because over time, the company can prove its model. 90% of companies fail in the first round of funding (before Round 2, 3, or 4). And as the risk goes down, so do the returns. The most risky part, VC investing – is so risky that they may lose 100% on 9/10 deals. But the 10% make well over 1,000% returns for the VCs. Venture Capital is a rough business. The ‘sweet spot’ to invest is highlighted in light blue – that’s before the IPO but AFTER the company has a proven revenue model that has stood the test of time.

I’m sold – Why Pre IPO Swap?

Basically, our technology enables lower costs and ease of use. We don’t guarantee that you can resell your shares, but we will help find a buyer on your behalf. Other firms require you to sign lockups that can be 12 or even 18 months. You don’t get on the cap table stuck in an SPV with no rights – and we put you direct with the companies, no LLCs or complex agreements. All of our analysis, alerts, intelligence – it’s all free. We never charge you a penny. We get intelligence that others don’t – and we give it to our clients free. Why? Because our idea is that we only make money when you make money – although a private equity investment can go either way – we don’t charge you up front and we don’t charge any other fees. Also, we have access to the best deals. We filter them so that we only present the best of the best – the Elite – to you. What our esteemed clients get access to, free:

- Access to the Hottest IPOs coming to Wall St. (often, access is limited to a number of investors such as 100 or 1,000)

- Alerts when firms like InQTel make a new investment. Be notified when InQTel (The CIA’s venture fund) makes an investment or solicits investors for a new round of financing.

- Private Company research and analysis reports, courtesy of our partners

Some examples of positive high yield deals

These are the ones we know about commonly, Facebook, Twitter, LinkedIn; et al.

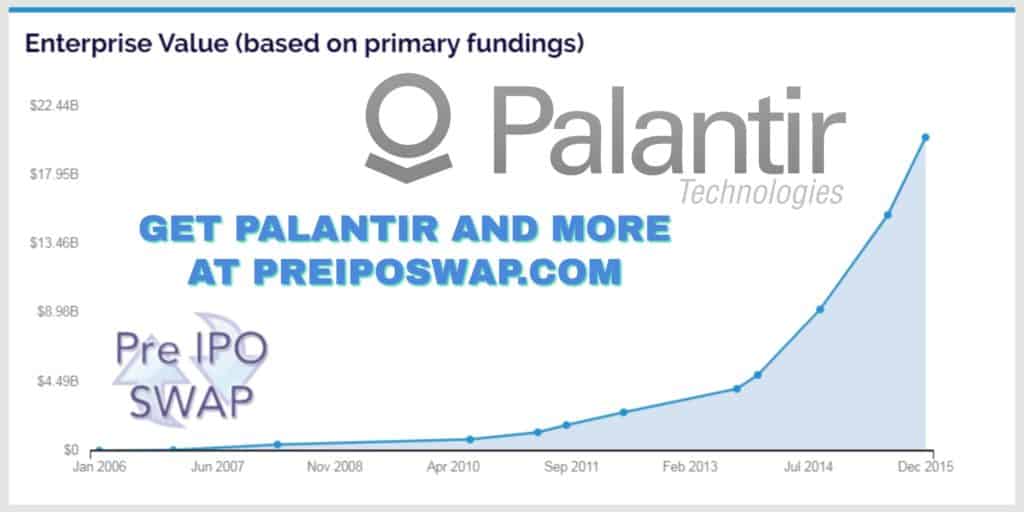

Less commonly known is Palantir, a company that makes software that can prevent terrorism. Palantir was founded by a group of investors from Silicon Valley including but not limited to Peter Thiel and InQTel, the Venture fund of the CIA. The returns of Palantir have been astounding, take a look at this chart:

This is based on primary fundings, which are events when rounds of financing occur. Such data is taken ‘as is’ and not audited or verified. Now that Palantir is planning to go public (known as IPO) there are public estimates of valuations placing it above $40 Billion. They haven’t disclosed exactly how much was the original seed funding for Palantir, but whatever it is – this represents a huge return for not only the original investors but for later stage investors too. And it’s not without reason, not only does the company do something useful, it has revenues. Last year the company earned about $600 Million and expects to earn $750 Million this year.

Another great example is Uber, something simple yet effective – disrupting the outdated and inefficient Taxi industry. Uber investors will get a 2,000x return:

The valuation of Uber is poised to hit an eye-popping $17 billion in its latest round of funding. (Update: the company confirmed this valuation, along with the round of $1.2 billion in new funding, on Friday.) That makes the four-year-old black car startup one of the most valuable private technology companies in the world. As a result, the startup’s early investors, whose shares are now worth as much as 2,000x their initial investment, are looking pretty smart.

NOTE: That’s 2,000x NOT 2,000% – That means even a tiny little $20,000 angel investment is now worth around $40 million.

Obviously, such returns are unheard of in NASDAQ issues – the only way to access something like this is Pre IPO investing, such as offered by Pre IPO Swap.

Our Pitch Deck

This is the most simple Pitch Deck you’ve ever seen – as it should be. This is a simple business that solves a simple problem and a win-win for all participants involved.

The hard close

Do you work for a company about to go public and need help monetizing your options prior to the IPO? [That means, you are a ‘shareholder’ – we call that the ‘sell side’ ]

Or are you like many of us waiting for your broker to call with a hot IPO? Unless you’re already a financial whale, it probably won’t happen. Of course after the hot IPO opens you’re free to buy. but at the “post IPO inflated prices” does it make sense anymore? What if there was a way to acquire the shares Pre IPO at a fraction of the IPO price? Now instead of “being a buyer of inflated IPO shares” you’ve reversed roles. Imagine selling at these Post IPO prices. [This paragraph is for you – the investor. We call this the ‘buy side’ ]

If your financial plans in the market include “upgrading your freedom, fostering your retirement, your kids’ education and or continuing on your family dynasty, then you’ve already realized the idea of waiting around for a broker to call you with some “hot tip” or hot IPO to get you there isn’t likely going to happen….and that’s why you’re here.

One of the greatest feelings in the world will be to tell your Broker that instead of buying his recommendation at of a company that IPOd at 80 and up to 110 you’re considering selling some your position to him at a discount (and a profit to you). And why not sell some and take some chips off the table, and repeat. Billionaires in the market who achieve financial greatness do so by acquiring PreIPO-shares in their own companies and for large institutions. Click here to Meet the Uber Rich.

We don’t know of a single Financial Wizard who has not benefited from private equity/PreIPO shares. In fact, even those who are not the greatest financial wizard’s and some of the many rich and famous people you know made most of their money in PreIPO shares, even as actors, to the lead singer of U2. Material amounts money was made and PreIPO shares. What if I were to tell you that the CIA had a venture fund that did nothing but invest in PreIPO companies. Palantir is a wonderful example.

So, I’ve discussed this PreIPO business that benefits billionaires, the CIA, the rich and famous and who else follows this method? How many times have you seen the once PreIPO companies that are now massive? Every week you hear about these major companies buying companies, but with one subtle difference – they almost NEVER buy a company that is already public – they are all PreIPO. Why? Two reasons. price and sanity.

Because watching a company go from PreIPO to IPO and then to Post IPO, then 20 days post IPO when the underwriters and Analysts will begin pumping the shares vis-à-vis booster shot reports in the form of buy recommendations, is only going to make the company’s shares incredibly expensive. Too expensive to buy now, so no company would wait for a company to IPO. i wanted to buy it they would obviously and only buy it before I did.

So why do all the rich famous and connected people get to do this, and you never hear about regular people doing it? Well some very savvy professionals realized how unfair this was as it slants the playing field in favor of the rich. So remember the next time he bought an IPO or post IPO company, you’re buying one of those rich people’s famous shares who likely paid 1/ 20th of what you did. Now ask yourself if what you are currently doing still makes financial sense. If you’re an accredited investor you have options. This is your life star in it. The market is not a spectator sport although many treat it so…and repeating the same actions and expecting a salesperson i.e. broker to call you with a financial idea if it’s going to change your life then…you could stay waiting and by the phone.

Or contact us so the next time you’re at a dinner party and hear: “Did you hear how much [Silicon Valley Executive] made on [the last hot IPO], this time you can smile to yourself knowing you also invested in the same PreIPO shares. “Actually, I am a PreIPO investor and invested in the same. I’m selling at these prices. You should have bought “before it went public.” Excluding the single method that has created and maintained much of the mega rich – wealthy – would simply be irresponsible. This method has maintained every single Billionaire, Silicon Valley Mega Star, to Bill Gates to Jack Ma, the entire technology giants, to Chinese TenCent behemoth which has made billions per transaction in multiple PreIPO companies in just the past year.

SIGN UP