Pre-IPO investing provides Accredited investors access to mature, usually multi-billion dollar companies that have not yet gone public.

Although the obvious exit is the IPO which can bring a good return, it is possible to resell shares of the company privately, through Pre IPO Swap. The transaction is private but completely transparent to both the buyer and the seller.

Pre-IPO investing is risky because shares are traded only privately. Public companies are required to comply with many Federal and State regulations that private companies are not required to. Thus, it is more difficult for investors to obtain accurate and/or audited information about private companies. However, it is also possible for a high return on investment, such as 1,000% or even greater.

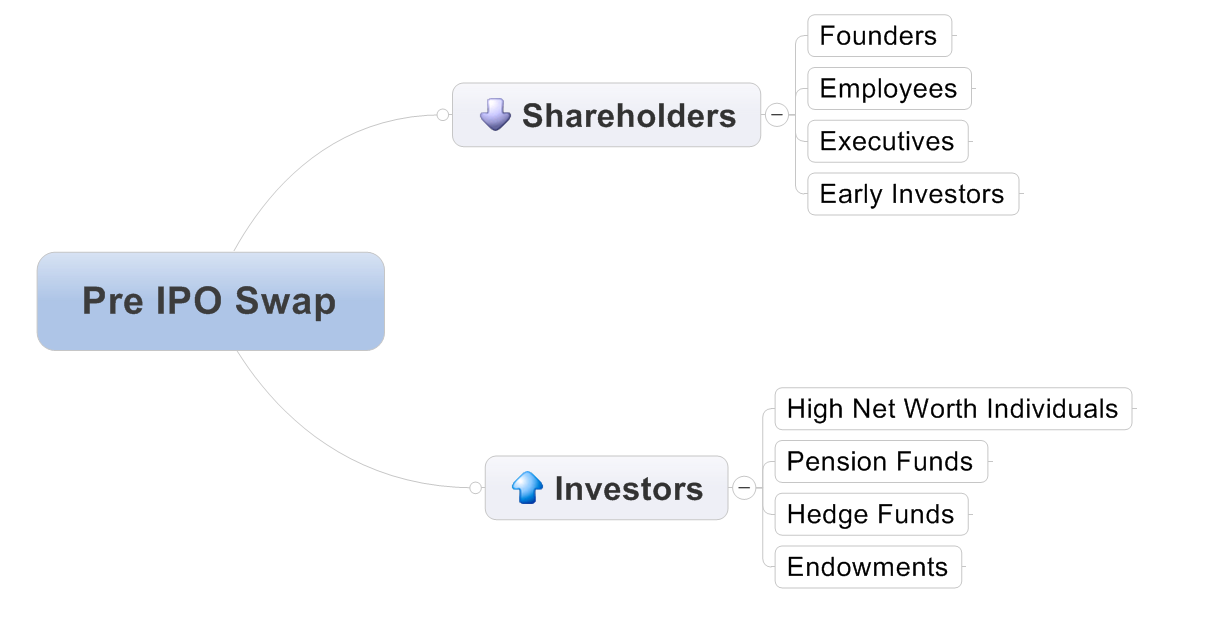

There are 2 types of participants in the pre-IPO market, as in any market. There are buyers and there are sellers.

Buyers are the investors who want to buy the pre-IPO shares. Who are the sellers? Why would anyone want to sell their shares?

The answer is simple, there are 2 types of sellers, typically.

Employees

Good talent is incentivized to work at cash strapped startups with stock options and other stock related bonuses. This model works and so is widespread in early stage, growth companies. When employees get access to their stock (it is often restricted, both in time and in quantity) they usually sell it to get the money. Often they will not sell all of their stock, but they will usually sell most of it as it is really part of their otherwise would be salary.

Angel Investors (VCs)

Angel investors who were the original investors or early round, may have waited for years and want an exit. Often they may sell some shares to pay expenses, taxes, or to liquidate and make other investments. The fact that early stage investors sell out is not a sign the stock is going down (the thinking may be, why don’t they just hold if it is likely to go up?). The fact is most institutional investors will liquidate some of their holdings on an ongoing basis for a number of reasons. They may also buy more – just because a VC sells some of his private stock doesn’t mean he won’t try to buy it back in a few months or years if he learns something.

Key differences Pre IPO Investing

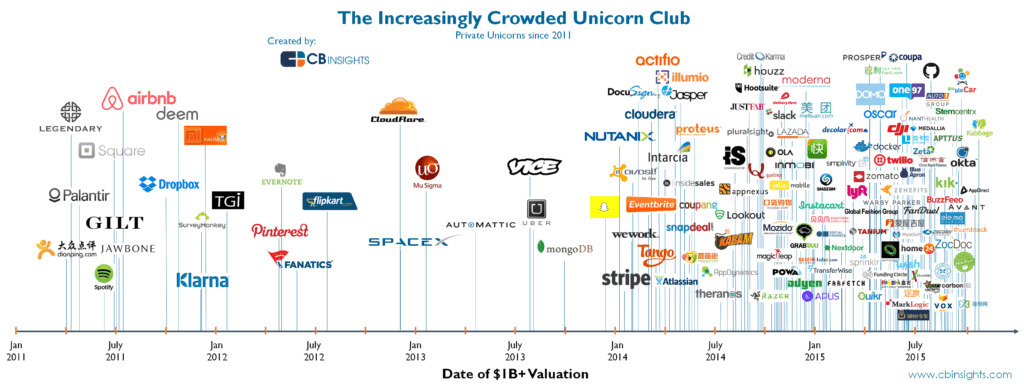

Pre IPO Investing is certainly not for everyone. But if you are looking for alternatives, it certainly is better than other options. In fact, the Pre IPO investment market has grown substantially in the past 5 years, making the Unicorn space almost crowded (see this image):

But still, that doesn’t mean that there aren’t choice deals to be made, and not all of these will IPO. What analysts have to say about the 2019 IPO Season:

What ‘surprise’ do you see in the market that isn’t currently getting sufficient investor attention?

For the U.S. IPO market, there are still only about 200-250 IPOs in a typical year, far reduced from the usual 700 per year in past decades. Combined with enormous amounts of available capital in the world seeking returns, the relatively small supply of new issues creates a supply/demand imbalance. So, it isn’t terribly difficult to make money on IPOs, assuming investors avoid overpaying for over-hyped new issues.

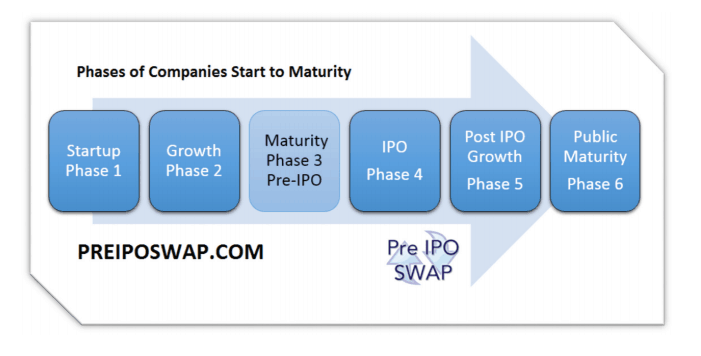

Pre IPO investing is the best time to get in, because when a company IPOs it’s being made for the consumer. That’s a good thing – for consumers – but not always for investors. Investing in the beginning of a company is risky because you don’t know if the model is going to fail or not. Here’s a chart of the common phases of company growth and development:

The ideal place to invest, with ‘just the right’ amount of risk and reward – is Phase 3 (Pre-IPO). Earlier phases have high risk (even 100% risk, a startup can completely fail). Later phases have much less risk and much less returns. The average ‘new’ issue IPO has returned between 12% – 14% from the IPO date to a year out – a good return, but nothing like the Pre IPO returns of Facebook and others like it.

NOTICE: PreIPOSwap.com is a website – we are not a broker-dealer or fiduciary. We provide technology to financial institutions. We are not a broker or custodian. We will never ask you for money. We do not offer investment advice or solicit securities.

SIGN UP