What’s holding Private Markets back | ZeroHedge

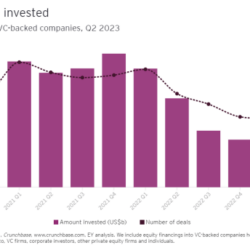

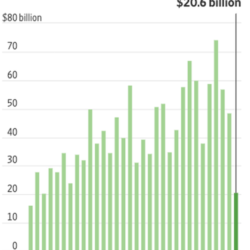

From: zerohedge What’s holding Private Markets back | ZeroHedge From VCC: 11/10/2023 Private Markets including VC funding, Pre IPO secondary’s, primary financing rounds, and other private deals have ground to a halt. Overall volumes are down, number of deals are down, and the bid/ask spread has widened. Private markets are opaque and complex, however, the[…]