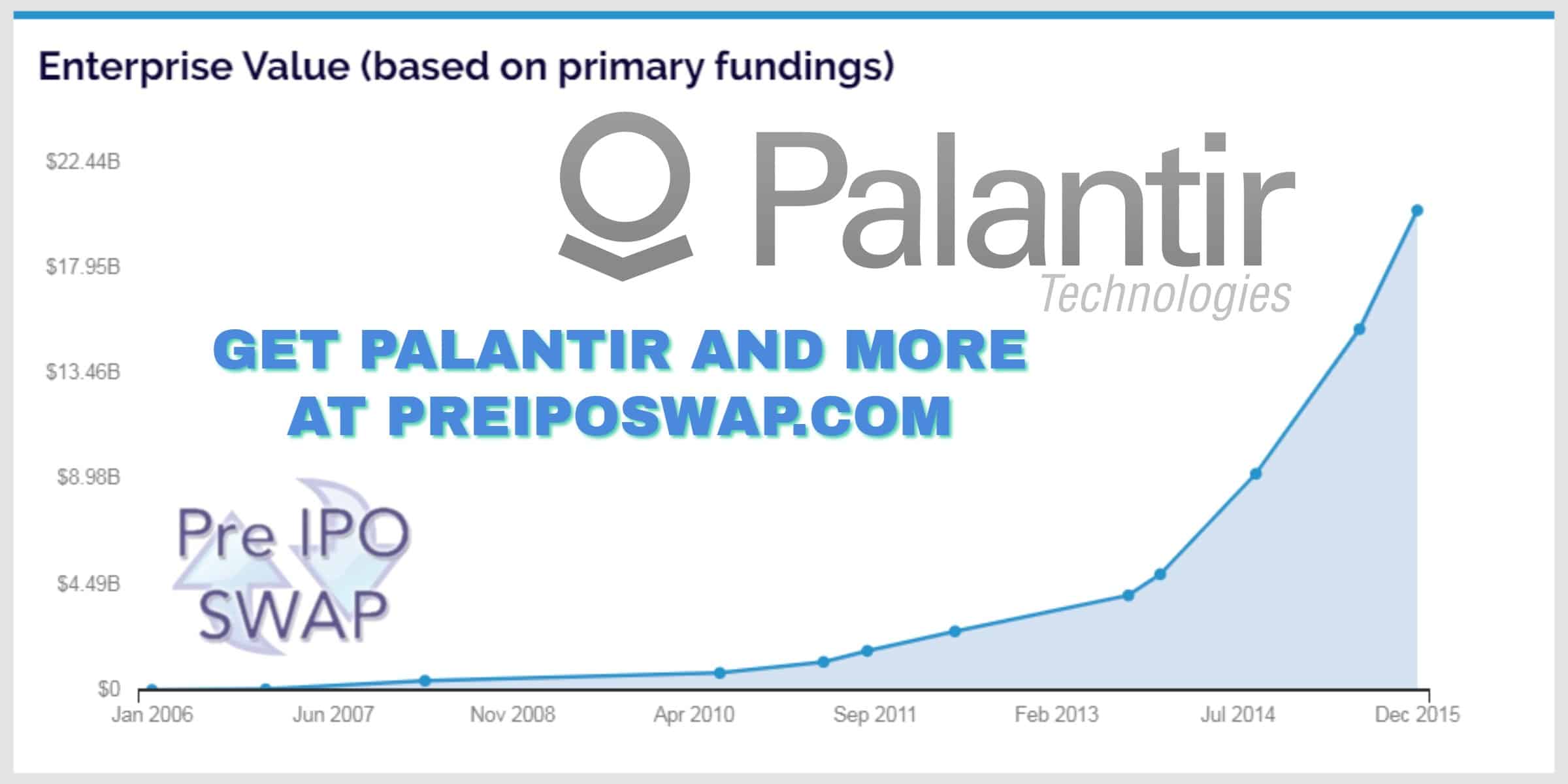

Pre IPO Swap – (New York, NY 1/26/2019) – Pre IPO is when you transact shares of a company which is about to become a public company, a process known as IPO. The Pre IPO market is for accredited investors only. Popular names currently on the table include Lyft, Palantir, SpaceX, Klarna, Pinterest, and Stripe. This is well known.

What is NOT known is how most companies are structuring this transaction. They create a fund to do it. So investors are actually making an investment into the fund – NOT into the shares. What’s the difference? Well for one, if something goes wrong – you have no shareholder rights. Second, there are more fees – including but not limited to 20% of your profits. And an exit fee. That’s right – you have to pay up to 5% commissions when you buy AND when you sell! Of course they will say – it’s all part of investing and if you make more than the fees then you are still ahead. That’s fine – they need to eat too – but they aren’t providing any sort of advice or additional Alpha when you can get the shares directly without all the fees at places like Pre IPO Swap.

They are holding your shares hostage – for a huge ransom – 20% of your profits.

You don’t get on the Cap Table – they don’t even tell you what a Cap Table is because you are wrapped in an LLC which acts like an investment pool (this is the fund). It tracks the shares as if you bought the shares – but you don’t actually own the shares. So you are really investing in Example Pre IPO Fund LLC and not Palantir, SpaceX, Uber.

What do Pre IPO Swap purchasers all have in common?

- They understand value.

- They are looking for an edge.

- They are looking for that next disruptive technologies and companies.

- They value their time and they know that time is best spent with loved ones and enjoying the world’s treasures.

- They don’t need to look at quotes every minute because they purchased prior to the IPO.

- They have a vision of their financial future.

- They want to have control over their financial future.

- They recognize that finance is not a spectator sport.

- They (themselves, not through an LLC) get on the cap table.

So why do Pre IPO investors invest alongside billionaires?

Answer: Because they can!

What are some other problems with funds? Funds can’t be hedged. What does that mean?

If you own shares of an IPO which is about to go IPO shares will be restricted however the restrictions vary greatly in time and other details. But you can always hedge your shares because you own them – they are yours. That means you can sell covered calls on them, and many other things. Here’s a famous example by none other than Mark Cuban, who protected 1.4 Billion in restricted stock during the sale of broadcast.com:

Back in 1998, Mark Cuban and his partner Todd Wagner sold Broadcast.com, a giant multimedia company focused on streaming audio and video, to Yahoo! for $5.7 billion. At the time, Mark Cuban received 14.6 million shares of Yahoo trading at $95, thus his concentrated position had a market value of $1.4 billion. In order to protect the value of the 14.6 million stocks he decided to set up a costless Options Collar, which allowed him to protect his billions without paying any insurance premium. Probably because there was a lock-in period for him to sell the Yahoo share, or he used these Yahoo shares as collateral for a bank loan, or he didn’t want to miss the opportunity if Yahoo continued to rally, he chose to enter a collar to lock in his share value without selling the shares.

This is one way to protect your position in Pre IPO without actually selling the shares. But if you’re stuck in a fund – you can’t do that. And there’s lots of other things you can’t do. Hopefully you’ll make friends quickly with the other LLC members, after all you are all on the raft together.

And one more thing. We shouldn’t presume to make statements about “Pre IPO Funds” as there are many and they are all different – there can be worse scenarios like fund specific lock ups, fees or penalties, and other features of a fund that are just the nature of being in them.

We’re not judging – we just feel that funds should be more forthcoming about explaining these nuances as it seems they are presented differently. The language is clearly misleading however since investors must be accredited it’s ‘OK’ to use misleading language because accredited investors are supposed to know the difference between buying into a fund and buying shares directly. But that’s not the point – investors just don’t know that it’s possible to do otherwise, that means the funds lead them to believe only through these fund vehicles is it even possible to get these shares – when that clearly is not the case. Investors can transact direct and get on the cap table no LLC, and no 20% profit sharing fee. (We note here, fees have their place – such as managed accounts, or a hedge fund quantitative strategy. But sharing 20% of the profit from a single stock trade with your broker seems egregious.

SIGN UP