As was reported previously, Robinhood Markets – which is rushing to preempt any more fiascos and market crashes and go public as quickly as possible – has filed for an Initial Public Offering listing on the Nasdaq with the ticker HOOD (S1 filing here) and will use Goldman, Citi, JPMorgan and Barclays; in a novel twist, one which supposedly panders to the company’s client base, underwriters are expected to reserve 20-35% of the offering for Robinhood’s own retail investor clients.

As is customary, the S1 has listed a proposed maximum offering size of $100 million (which is a traditional placeholder) but the final offering will likely be much larger; and according to analyst estimates, HOOD could be worth as much as $40 billion.

The offering comes one day after Finra imposed a record $70 million penalty on Robinhood for a variety of securities laws violations, which included lapses in overseeing its technology and options trading, and of misleading customers, leading to losses. Robinhood neither admitted nor denied wrongdoing.

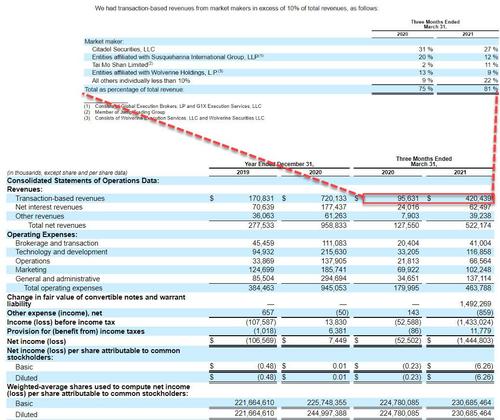

Some of the things we learned from the filing is that the company generated $958MM in total revenue in 2020 of which $720MM was from payment from orderflow. The company made more than half of this total amount in just the first quarter, when it made $420MM in transaction-based revenues (and $522MM total, up from $128MM a year ago), of which Citadel accounted for 27% of total. Payment for orderflow was 81% of total.

And while the company generated $7MM in net income in 2020, it’s unclear what the number was in Q1 due to a substantial change in accounting treatment of convertible notes in the period, although excluding it would suggest that net income was solidly positive.

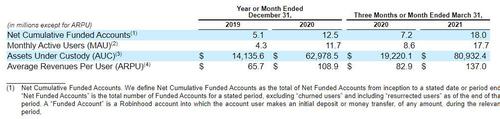

Robinhood also revealed that it had 17.7 million monthly active users which commanded just under $81 billion in assets. Robinhood made $137 on average from each of its users.

Some more demographics: 70% of Robinhood’s AUC came from customers on our platform aged 18 to 40, and the median age of customers on the platform is 31. According to Robinhood, “most of our customers are primarily buy-and-hold investors, and the vast majority of our customers are not considered to be “pattern day traders” as defined under FINRA rules.”

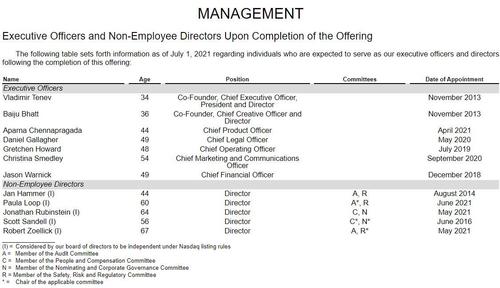

One look at the management section reveals that Robinhood added several names to its board ahead of the planned IPO, tapping such establishment figures as Jon Rubinstein — nicknamed the “Podfather” for his role in developing the iPod for Apple Inc. — along with former World Bank president Robert Zoellick. PricewaterhouseCoopers partner Paula Loop, who has experience working with companies in the retail industry, joined June 17.

As noted above, Robinhood said it has about $81BN in assets under custody, a metric that includes all the holdings in customers’ accounts, excluding margin they use. While an overwhelming majority of that sum is held in equities, $11.6 billion, or roughly 14%, is held in cryptocurrencies, signalling Robinhood users’ appetite for the risks and rewards of investments like Bitcoin.

And speaking of cryptos, here is something even more notable: the company discloses that in Q1, 34% of HOOD’s cryptocurrency transaction-based revenue was attributable to transactions in Dogecoin, as compared to 4% for the three months ended December 31, 2020.

“As such, in addition to the factors impacting the broader cryptoeconomy described elsewhere in this section, RHC’s business may be adversely affected, and growth in our net revenue earned from cryptocurrency transactions may slow or decline, if the markets for Dogecoin deteriorate or if the price of Dogecoin declines, including as a result of factors such as negative perceptions of Dogecoin or the increased availability of Dogecoin on other cryptocurrency trading platforms.”

In total, there were 10 mentions of Dogecoin in the filing.

To be sure, the one thing most investors will be focused on is the company’s discussion of Payment for Orderflow, or PFOF, now that SEC head Gary Gensler has criticized it and the SEC is reportedly probing the practice. This is what Robinhood had to say (there were no less than 18 mentions of PFOF in the S1):

- Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”), reduced spreads in securities pricing, reduced levels of trading activity generally, changes in our business relationships with market makers and any new regulation of, or any bans on, PFOF and similar practices may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.

- A majority of our revenue is transaction-based, in that we receive consideration in exchange for routing our users’ equity, option and cryptocurrency trade orders to market makers for execution. With respect to equities and options trading, such fees are known as PFOF. With respect to cryptocurrency trading, we receive “Transaction Rebates.” In the case of equities, the fees we receive are typically based on the size of the publicly quoted bid-ask spread for the security being traded; that is, we receive a fixed percentage of the difference between the publicly quoted bid and ask at the time the trade is executed. For options, our fee is on a per contract basis based on the underlying security. In the case of cryptocurrencies, our rebate is a fixed percentage of the notional order value. Within each asset class, whether equities, options or cryptocurrencies, the transaction-based revenue we earn is calculated in an identical manner among all participating market makers. We route equity and option orders in priority to participating market makers that we believe are most likely to give our customers the best execution, based on historical performance, and we do not consider transaction fees when routing orders. For cryptocurrency orders, we route to various market makers that we believe offer competitive pricing, and we do not consider Transaction Rebates when routing cryptocurrency orders.

And the punchline: the admission that if the SEC bans PFOF, the Robinhood is a doughnut:

- To the extent that the SEC, FINRA or other regulatory authorities or legislative bodies adopt additional regulations or legislation in respect of any of these areas or relating to any other aspect of our business, we could face a heightened risk of potential regulatory violations and could be required to make significant changes to our business model and practices, which changes may not be successful. Any of these outcomes could have an adverse effect on our business, financial condition and results of operations. For more information about the potential impact of legal and regulatory changes, including changes to regulation of PFOF, see “—Our business is subject to extensive, complex and changing laws and regulations, and related regulatory proceedings and investigations. Changes in these laws and regulations, or our failure to comply with these laws and regulations, could harm our business” and “—Risks Related to our Business—Because a majority of our revenue is transaction-based (including payment for order flow, or “PFOF”), reduced spreads in securities pricing, reduced levels of trading activity generally, changes in our business relationships with market makers and any new regulation of, or any bans on, PFOF and similar practices may result in reduced profitability, increased compliance costs and expanded potential for negative publicity.”

An amusing tangent, in the risk factors we read that “unfavorable media coverage could harm our business, financial condition and results of operations.” Well then maybe stop making it so easy…

And another interesting, if less relevant risk factor: the U.S. Attorney’s Office for the Northern District of California executed a search warrant for CEO Vlad Tenev’s cell phone earlier this year. This was as a result of various state and federal probes tied to the trading restrictions it invoked amid the GameStop frenzy.

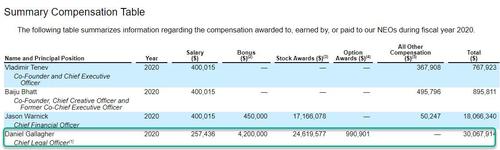

One final relevant fact: Dan Gallagher, the former SEC Commissioner from 2011 to 2015, who is now Robinhood chief legal officer, received just over $30 million last year after joining the company in May 2020. Most of it came in stock that he’ll collect over the next few years.

Bottom line: if Robinhood’s relationship with Citadel – where it effectively acts as a subsidiary – is severed, or if the SEC bans PFOF, the value of Robinhood would flash crash from $40BN to $0.

SIGN UP