Update (1234ET): As expected, Robinhood will offer its users allotments of its shares at the IPO price via its “IPO Access” program.

It’s only fitting that the discount brokerage that drew millions of traders back into the market will rely on retail buying to juice its shares out of the gate.

Who else will reliably absorb all the inventory being unloaded by company insiders?

* * *

As it moves closer to its IPO planned for later this summer, Robinhood said in an amendment to its S-1 (the document initially declaring its intention to sell shares on the New York Stock Exchange) that it plans to raise more than $2 billion and offer 55MM shares at a price between $38 and $42.

Should its shares debut at the top of that range, Robinhood (which will trade under the ticker HOOD) would be worth $35 billion.

The announcement of the price range marks the start of Robinhood’s road show to market its IPO to potential investors. The firm will start meeting with investors this week. To be sure, as investors learned during the WeWork debacle, the company’s valuation could still change depending on fluctuations in investor demand.

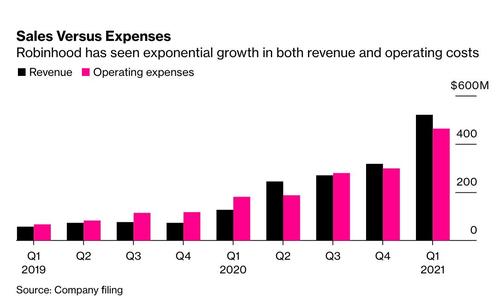

Thanks to the boom in day trading seen during the pandemic, Robinhood has seen its monthly active users more than double over the past year, with 17.7MM as of the first quarter, up from 8.6MM in the same period. The firm was valued at $30 billion during a funding round earlier this year.

Investors have rushed to buy shares of new IPOs in what has been a record 15-month run for new listings in the US. The company recently launched a program to allow retail users access to new listings directly at the offering price, an offering that rivals like SoFi are already mimicking.

Of course, Robinhood has also faced its fair share of controversy. It’s CEO and co-founder Vlad Tenev was dragged in front of Congress after the company shut off trading in shares of GameStop and other meme stocks back in January. While Robinhood claimed the decision was made because the firm had to raise money to meet a massive margin call by the broker’s clearinghouse. But suspicions have lingered that the firm routinely cuts off trading when it benefits market makers like Citadel (which also runs an extremely profitable hedge fund) which is Robinhood’s largest client.

Source: Bloomberg

The lead underwriter for the Robinhood IPO is Goldman Sachs, which is being joined by a handful of bulge-bracket banks along with a smattering of smaller advisory firms.

Robinhood’s practice of payment for order flow has also been criticized for fleecing retail investors while claiming to saving them money with the smokescreen of zero-dollar commissions on stock trades (while increasing “game-ification” increasingly pushes retail punters toward options and their juicy spreads.

SIGN UP