(PreIPOSwap — 9/26/2019) New York, NY — We get asked often about fraud in Private Equity as it’s an Over the Counter (OTC) market and not exchange traded. Our answer is the classic answer – the majority of the risk lies in the underlying asset, i.e. the stock you’re buying, not the secondary market counterparty. Fraud exists in Pre IPO as in any industry but is easy to detect especially when transacting with regulated counterparties. Like the FX market, which is completely unregulated and untamed, the majority of counterparties in Pre IPO are regulated investment banks, broker-dealers, or Venture funds with substantial capital (they may be exempt, but they are highly regulated due to their size). When dealing in SPVs, the administrators and custodians where they are held are typically large custodians that have insurance which often is superior to SIPC and FDIC. The fraud risk would be, someone posing as one of these institutions but really wasn’t. This was the scam method used by classic ponzi scammer Trevor Cook, who created US based Dummy Corporations with the exact name of the legitimate Swiss “Crown Forex.” Understanding and learning about past frauds enables us to better detect possible frauds in the future.

So it comes as a great source of consternation that we read and post this damaging information about WeWork, potentially the first Pre IPO Fraud. Why fraud you say, WeWork is everywhere in NYC? WeWork is a real company, it’s not a ponzi scheme?

Remember that Enron was trading in energy markets and many other markets, and lots of investors made money in Enron. It was a fraud, but it wasn’t a complete MLM Ponzi scheme – Enron had a real business. They just crossed the line of using their capital and market influence to manipulate markets which is illegal. What’s the definition of Fraud:

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law, a criminal law, or it may cause no loss of money, property or legal right but still be an element of another civil or criminal wrong.

So here, we aren’t stating that WeWork is a fake company, clearly not. Many of us have worked in or visited WeWork offices. We are stating that based on evidence we are including here below, which summarizes intentionally misleading statements made by WeWork founders and executives; that WeWork is a fraud based on deception, inflated projections while hiding liabilities. They covered this intentional misleading deception by having an aggressive marketing push, and involving celebrities like Ashton Kutcher who would make soft statements like “It’s not about the numbers anymore – it’s about how WeWork can impact the world.”

The real product

Anecdotally, we are looking at office space in NYC, New Jersey, Charlotte, Boca Raton, and Atlanta, for Crediblock.

Not really knowing about WeWork, we contacted Regus and the usual suspects one would for quick to setup office space without leases (or flexible terms at least). With all the WeWork in NYC we contacted them as well and did a comparison. Dollar for dollar, we’re not really sure what the allure is to WeWork – is it all branding? Free beer, stylish furniture? Really? Is that what the $47 Billion valuation is based on? See this simple comparison from Tyler (Zero Hedge) –

WeWork vs IWG

We: loss $1.9BN

IWG: profit $0.5BNWe: 29 countries; 528 locations

IWG: 120 countries; 3000 locationsWe: valuation $10BN – $47BN

IWG: $3.7BN valuation

We have to mention that we have used Regus in the past and the cool thing about it is that as you travel you have access to their worldwide network which you may pay for but anyway it’s very useful, to have an office in Boca Raton should you need a quick conference room to do a power point presentation at the last moment. 120 countries is really a lot of countries. One big negative, the smaller the lease term the higher the rate, just like for an apartment. Perhaps they have a more realistic tenant approach than WeWork? From the perspective of the renter – we looked at WeWork ONLY because of the discounted no-lease option. While this is obviously beneficial for small businesses and entrepreneurs, it’s not clear how this can be positive for WeWork.

We’re not jumping on the We-dumping here just stating our observations as potential customers of WeWork. And in the process of asking others how they like the WeWork, some of the ‘weworkers’ told us ‘it’s all about the networking’ where the tenants we knew said they never communicated with any of the co-workers and they were in ‘their own world’s’ – certainly NYC is not in need of more networking events, offices are places to escape from events and get work done. But the networking fit into the WeWork branding model, just like any great MLM needs great branding, WeWork needed a great story, and it had.

Fortunately, we never bought any WeWork and didn’t transact in it. Strangely, there were ROFR issues surrounding the company and rumors about brokers that were ‘cousins’ of the founders that could pass ROFR but we didn’t see any transactions happen in the secondary market. They did happen, and there was a market for it, we just didn’t transact in it. So for now, we’re writing this as a Post Mortem report that we can move on to productive and exciting things we have going on such as Blackwatch Digital, TransparentBusiness, and seeing what Palantir has up their sleeve this fall.

Research & Articles referenced

Here’s a collection of the top research articles on the topic, read and come to your own conclusions.

Articles in Full

When the WeWork IPO spectacularly imploded, it not only short-circuited SoftBank’s self-referential perpetual valuation engine and crippled the public’s demand for public offerings as observed by today’s Peloton fiasco, it also put WeWork entire future in jeopardy. The reason: a successful IPO would mean not only billions in much needed new capital but also continued access to billions in credit lines. Instead, as things stand now – with an IPO that has been put on indefinite hiatus as the company scrambles to decide what to do following the abrupt termination of its messianic CEO, Adam Neumann – WeWork only has enough cash to last to maybe next spring as it is losing millions of dollars a day; what’s worse, as Bloomberg warns, “It may be shut out of the public stock and bond markets to raise new money.”

In short: WeWork may have just months left before it has to file for bankruptcy.

That, as Bloomberg’s Claire Boston writes, is the grim situation confronting the office-sharing company days after a corporate upheaval that left its once-glittering plans shattered. Adam Neumann, who founded the company nine years ago with a promise to “elevate the world’s consciousness”, was ousted as CEO.

The most immediate problem, however, is that once the IPO was called off, until at least next year, it unraveled a $6 billion financing package. It is also the gargantuan challenge facing the company’s two new co-CEOs brought in to replace Neumann – Sebastian Gunningham and Artie Minson – who have to find a way forward for a company that was until just a few weeks ago one of the world’s most valuable private startups with a valuation of $47 billion… but has not only never made a penny in profit but saw its losses grow the more its revenue increased.

And with equity markets slammed shut for the company that top-ticked the IPO market, means seeking substantial new bank loans and private investments.

It also may mean shedding thousands of jobs and tossing out Neumann’s grow-at-all-costs ambitions.

But even getting a new bank loan will now be an uphill battle. WeWork is in talks with Goldman Sachs and JPMorgan about a new $3 billion loan, but as we reported a few weeks ago, there’s a catch: any such deal would also require the company successfully IPO. And that is for now at least, a dead end. This, as Bloomberg notes, could mean Gunningham and Minson returning hat in hand to its biggest investor – SoftBank, the Japanese company that has already pumped in more than $10 billion.

Will SoftBank comply? It very well may have no choice, unless it wants to see its entire house of VC cards collapse in a heap of smoldering valuation haircuts, which in turn drags down SoftBank itself (which as we reported yesterday has problems of its own, as Goldman is seeking to dump its loan exposure to SoftBank’s Vision Fund).

Just last night the FT reported that SoftBank is already in talks with WeWork to increase a $1.5bn investment the Japanese telecoms-to-technology group has agreed to put into the office leasing company next year. The question here is when will SoftBank’s own investors and employees put an end to this lunacy, in which Masayoshi Son keeps throwing good money after bed, a pet project which is putting the existence of one of Japan’s biggest firms in jeopardy, out of nothing more than hubris.

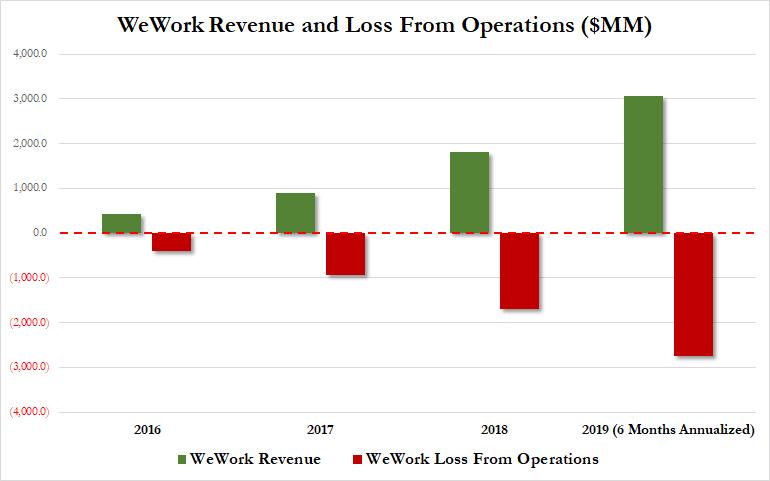

Of course, getting new capital is critical: as shown in the chart above, the company lost $690 million in the first six months and is expected to generate a loss from operations approaching $3 billion as it burns through tens of millions in cash daily. Which means that according to analyst estimates, with its existing $2.5 billion in cash as of June 30, the company could run out of money by mid-2020.

Such numbers could spell the end to Neumann’s profit-less growth ethos. When Fitch Ratings downgraded the company’s debt in August, it said the company had made a choice to prioritize growth over profitability by planning for more than 1.25 million new desks — more than twice what’s currently available — and plans to open in 175 new cities globally.

Worse; for next year alone WeWork had planned to add 725,000 new desks at a cost of about $4.5 billion, S&P Global Ratings has estimated.

However, without the news cash it will simply will be unable to do that; instead it will be forced to start dumping CRE exposure as it begins the inevitable pre-bankruptcy shrinking process.

As a result, as Bloomberg warns, WeWork’s very business model is now at stake.

WeWork has raised more than $12 billion to rent office space that it renovates and then leases to companies. But that strategy has left it in a precarious position. It has some $47 billion of future rent payments due. On average it leases its buildings for 15 years. Yet its tenants are committed to paying only $4 billion, and on average have leases for 15 months.

Those long-term leases “may become an albatross in an economic downturn,” Bloomberg Intelligence analyst Jeffrey Langbaum wrote in a report Wednesday, adding that WeWork needs to find a “clear path to profitability.”

And so, the new CEOs have no choice but to slash costs and expenses drastically as the company finds itself unable to rely on outside sources of capital. In addition to Neumann himself, how is now gone from the company’s C-suite, they new CEOs are weighing job cuts that could number in the thousands – to be sure, with over 12,000 employees, WeTerminate has a lot of fat to trim – as well as “eliminating or spinning out non-core businesses, such as WeGrow, an experimental New York City private school” a Bloomberg source said.

Deep cuts could free up meaningful resources: the company spent $184 million on payroll last year, and another $23 million in stock compensation.

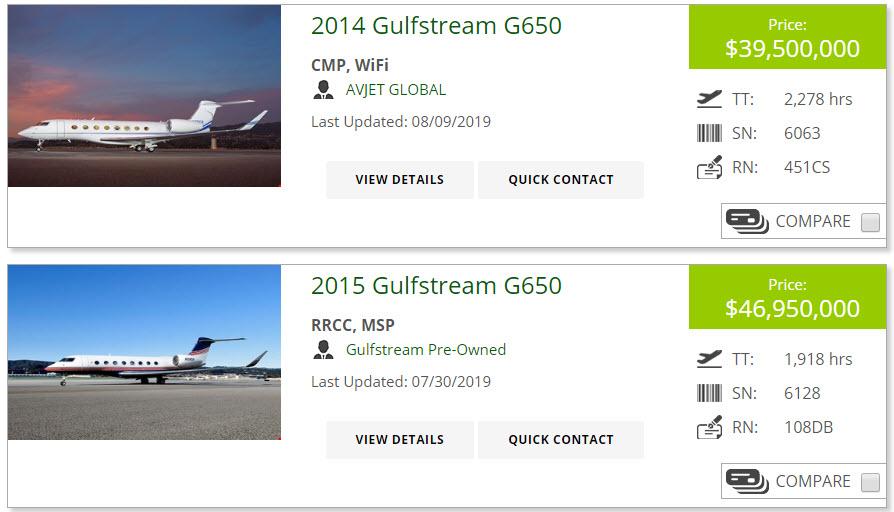

One upcoming disposition: Neumann’s famous private jet.

According to Business Insider, WeWork is set to sell the luxury Gulfstream that its cofounder Adam Neumann used to travel the world… “a symbol of the company’s corporate-governance issues that have in part derailed its initial public offering.” The company bought the Gulfstream G650 for $60 million last year. Some investors said the private plane was a corporate-governance red flag in the lead-up to the company’s IPO, according to a source familiar with the matter.

The Gulfstream G650 is considered one of the most luxurious and popular private jets available. The plane has a range of more than 8,000 miles — at top speed, it can fly from London to New York or Beijing, while at a slower, more fuel-efficient rate, it can get to Buenos Aires or Los Angeles, Business Insider previously reported.

It’s a popular jet among the rich and famous, as well as the executives of global corporations. Tesla CEO Elon Musk and former Starbucks CEO Howard Schultz are among the jet’s owners, as was the Apple CEO Steve Jobs. More than 350 G650 planes have been built.

Staff members told BI that they spent “three days straight” downloading thousands of movies and TV shows onto the plane’s media system. Neumann also often hosted meetings with employees as he travelled.

The problem here is that there is currently a glut of used G-650 hitting the market, and with an indicative asking price of around $40-47 million, WeWork is about to lose about to lose 20-30% on this “investment.”

Sale of the Gulfstream aside, whether or not it is successful in slashing its overhead will determine if WeWork has any future at all. The company has maintained that it could become a profitable company if it decided to cut its growth ambitions, and now it has no choice but to do just that; the question is will anyone be around to see it: The new co-CEOs have warned employees in an email that they “anticipate difficult decisions ahead” to protect WeWork’s “long-term interests and health.”

But how many of the company’s formerly generously rewarded employees will be willing to stick around pro bono? (don’t answer, that’s rhetorical).

To be sure, Bloomberg notes that with the equity market window shut, WeWork could try tapping the junk bond market again. But credit investors would demand a steep price. WeWork’s existing high-yield bonds yield about 9.8%, far above the average for junk bonds, which sit around 5.7%. On Wednesday, they were trading at the lowest prices since June.

And while it is not very likely, the next question is if WeWork does in fact succeed in slashing its cash burn, does it still face an imminent default. Here at least there is some good news: there is no hard default trigger until 2025 when its existing bonds mature. Meanwhile, with revenue of more than $3 billion in the first six months of this year (a number which will plunge as the company proceeds to slash costs), WeWork in theory shouldn’t have difficulty making interest payments on its bonds, which amount to $52 million in annual payments on the notes.

Still, as WeWork runs out the clock, will that be sufficient for any new investors to step up after the recent fiasco? Even as the new managers seek to clear up the company’s balance sheet to prepare for an IPO at some point, “The market is highly skeptical of this company,” said John McClain, a high-yield bond investor at Diamond Hill Capital Management.

Finally, should WeWork fail, it won’t end there, as the market will then focus on the company that made this farce possible in the first place.

“All eyes will be on SoftBank and how WeWork will proceed as they move away from Neumann.”

Is WeWork a Fraud?

So in a nutshell, this is what we know about this charade so far, apologies:

- Its not a technology company in any way, shape or form. No income is derived from the sale of a product or service delivered by a technology. They owe $47 billion in lease commitments. Claiming WeWork is a technology company is one of the many indicators that illustrate how Adam & Miguel maybe intentionally seeking to mislead and defraud existing & potential future retail investors. The product is physical space.

- When asked what inspired him to create a shared workspace company, Adam said that when he was growing up in Israel he used to live in a Kibbutz and was so mesmorised by the ‘sharing ideology’ that he invented Co-Working. Mark Dixon founded Regus in the 1980’s. LEO, Workspace Group, The Office Group, ServCorp, MWB, HQ and many others were around way before Adam thought up of this ponzi.

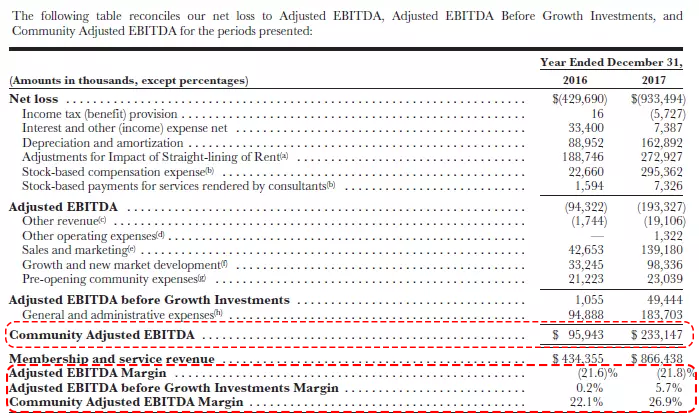

- WeWork post full year invoices for the year ahead this year to inflate their revenues. They then heavily discount those invoices they’ve already raised and treat them as expenses. They then pay whichever broker secured that lead 100%, yes 100% of the contract value. Note the industry standard commission is 10%. Neither the discounts nor the 100% in commission payments appear in their Financials as they are ‘community adjusted’. They also do the opposite, they turn expenses into revenues so imagine a landlord agrees to discount their rent by £250k to offset a portion of their build costs, standard practice, WeWork treats that £250k as revenue. They also charge members even after they’ve vacated, then credit them later. It’s not difficult to boost revenues on a blank cheque. Revenues are not what you’ve actually cleared through your bank, it’s the total tally of invoices raised in a given period, a big difference.

- The expenses as detailed in their accounts & S1 disclosure is not accurate. To hide two crippling cost groups; fit-outs & marketing, they invented a brand new accounting principle which they called ‘community-adjusted EBITA’S’. If they hadn’t they would have had to post actual accumulated losses in the region of $6 billion instead of the $4 billion reported. Why don’t we all do this. This is another strong indicator, they are hiding actual losses to mislead, knowingly. For somebody that can’t go a sentence without throwing in ‘community’ twice it’s interesting he’s never tweeted, his instagram features four landscape google images and he’s non-existent on LinkedIn.

- A brief search on any review site should show you the extent to which they couldnt care less about what their customers think. Despite rolling monthly contracts being sold with 3/6 month rent free periods for peanuts, with all the promotional freebies they provide, the free beer & festivals, 100% commission rates to brokers, billions in instagram adverts, 3 PR articles a day, none of their buildings are even near full and they are already experiencing falling occupancy rates. They even sent teams to walk into their competitor’s Centres to take photographs of tenant directory’s. That’s how desperate it’s become. Regus is currently engaged in legal action accusing WeWork of poaching customers and they are not the only ones who have accused them of engaging in this.

- Adam & Miguel have already collectively cashed out in excess of $1 billion in loans, royalties, salaries to extended family, private jets and who knows what other instruments (e.g. selling the We trademark he secretly purchased back to WeWork for a cool $6m), they’re chilling, and reportedly less and less involved in the day to day running. Miguel is more involved in a range of other businesses and has already demoted himself from Co-Founder to Head of ‘Global Culture’, quietly positioning himself for a quick exit post-IPO. Adam on the other hand fancies himself as the next Masayoshi, he has his own ‘venture capital’ firm investing in genuine entrepreneurs. Why would either of them care what happens to their remaining holdings, they’ve already cashed out enough to set up their grandchildren for life.

- Adam & Miguel then used the funds extracted from WeWork and funnelled it through privately controlled offshore investment vehicles and almost overnight built an asset-rich portfolio of prime commercial real estate (not an asset-light illusionary hustle). It doesn’t end there. Adam & Miguel then lease those buildings they privately acquired. back to their very own ‘spiritually’ valued WeWork at a ridiculously high yield. Even the very founders are bleeding their own ponzi scheme dry. Are these guys something or what. Further buildings were then acquired with loans (from JP Morgan) totalling $500m hedged against their already saddled collateralised. junk obligation WeWork. It’s not enough that they’re making $230m in fees flogging this ponzi.

- When they got caught, Adam tries justifying it by claiming he acquired the buildings years ago as a way of proving the concept works. An outright lie, and very insulting. If Adam can do and then conceal all of these things, imagine what else we don’t know.

- With pressure mounting, he arranges to appear alongside his actor friend Ashton Kutcher in an ‘Exclusive’ interview on CNBC . Ja Rule, sorry I mean Ashton Kutcher, in his trademark goofy-like character plays his part to perfection…. ‘When I realised it was a technology company I also realised that this company, through its technology, has the greatest capacity than any other company in the entire world to bring people together’. He’s using an actor to convince people his act is for real. (https://www.cnbc.com/video/2019/01/14/watch-cnbcs-full-interview-with-ashton-kutcher-and-wework-ceo-adam-neumann.html).

- The only reason it was valued at $47 billion is purely because one individual in Japan bafflingly and solely invested a total of $12 billion, in 9 separate funding rounds, each at double the price (and valuation) he (and he alone) paid less than 6/12 months prior. Since Softbank first invested in 2012, nobody else has invested. The only two people who claim WeWork is worth $47 billion are Masayoshi Son and Adam Nuemann. As long as we’re debating, and continue doing so until after the IPO Adam & Miguel are loving it.

- Why would Masayoshi, an intelligent individual, invest so many billions into this barefaced fraud, for the life of me I cant figure it out. Maybe Adam & Miguel deceived Masayoshi & Softbank too. Or it could actually really be as simple as it looks. It’s impossible for Adam and Miguel to sell their shares on the secondary market or post-IPO for $100bn+ if Masayoshi didn’t allow Adam & Miguel to parade WeWork in the press as being worth $47 billion, using purely Softbank’s 9 sole investments & revaluations. Once they exchange, media outlets can run headlines that project an aura that they are indeed worth what two people have decided to value it at. Everybody in the loop benefits, from the early investors that hope to offload their investments to later stage mugs, to the media outlets and banks Goldman Sachs’ & JP Morgans who earn hundreds of million in share sale commissions. Everybody wins. No one is accountable.

- Even Adam’s wife Rebekah, persuaded Masayoshi to sink $100m into her very own pet-ponzi, WeGrow, ‘the future of education’. Cute no, his and hers.

- It was only until the Saudi’s threatened to pull their funds out of the Vision Fund when Masayoshi reconsidered and decided to pull a proposed further investment of a whopping $16bn (which would have brought the total amount invested in/borrowed by WeWork to a laughable $30 billion, 15x what Facebook raised). This is what may have alarmed Adam to quickly initiate the IPO. He may now be afraid that if he agreed to delay the IPO he wouldn’t be able to re-submit later without providing a more scrupulously drafted breakdown of WeWork’s finances. He may also be worried that if a permanent suspension of the IPO happens, the company may not survive.

- Adam & Miguel have consistently been way off any of their forecasts made in their original pitch deck to investors (available online). He forecasted profits of $14 million in 2014, $64 million in 2015, $237 million in 2016, $542 million in 2017 and $1 billion in 2018 (on revenues of $3.6bn, a 36% profit margin). Their ‘community-adjusted’ accumulated losses amount to over $4bn, their actual losses are much higher. WeWork sued a whistleblower who raised alarm bells in 2016 when she revealed how WeWork had slashed their profit forecasts by 76%. When Bloomberg revealed this, WeWork claimed that it had ‘over-estimated’ what landlords would be willing to front in build out costs. But according to Adam ‘Because we have 40% margins, we can choose when to become profitable’.

- Two profitable serviced office groups, the largest IWG (Regus & Spaces) and the most luxurious LEO, who collectively manage in excess of 3500+ centre’s have been on the market for close to 2 and half years now and they have not been approached by anybody willing to pay a multiple of more than 1.25x revenues, which would make IWG valued at between $3/4 billion. SoftBank could have acquired four Regus’s for their $12 billion and still have enough change to sprinkle some fairy dust on top. Instead they’re losing one Regus a year.

- Facebook raised $2.2 billion pre-IPO. Google raised $130m pre-IPO, Ebay $6.9 million. WeWork has raised $14 billion so far, 7x what Facebook required pre-IPO, 140x what Google needed and they’re not even a technology company. Where has that $14 billion gone? They raised $14 billion, have less than $1.5bn cash and have nothing to show other than $47 billion in lease commitments and a portfolio of supersized Starbucks’s which are beginning to look outdated and in need of urgent refits. Airbnb on the other hand is a technology company, has raised $4 billion and posted profits of $93m last year on $2.4 billion in revenues. No money has been swindled out of Airbnb, they’re fiscally responsible and taking their time, waiting for the right moment to IPO. No rush.

- Serviced Offices as anybody in the industry will tell you generates almost as much yield as your traditional commercial landlord, typically 2/3%. Serviced Offices used to be very profitable when there were few half decent ones around but today they’re everywhere and desk prices have collapsed whilst conventional leasing rates have held steady. It’s not just been around since the 1980’s but now everybody’s getting into it, even developers British Land & Boston Properties are beginning to include it as part of their offerings. Now its purely a landlord play. Cafe’s and Hotels are jumping in too, even brokers are building their own platforms where they act as operator, Knotel, Instant Managed, CBRE to name a few. Even Google have a platform, ‘Campus’, very cool place. Adam though doesn’t think they’re come close to being a threat, ‘Our biggest competitor is work itself’.

- Serviced Offices is like the hotel industry only many times simpler, its just desks, chairs, simple decor in common areas (plants & picture frames), wifi, electricity, daily cleaning, plates and cutlery, and maybe a plug in telephone handset. Or you can just hire one of the many contractors WeWork use (John Robertson Architects, Oktra etc) although most floors are just glass partitioned boxes (they don’t do stud walls). LEO, Spaces and some of TOG’s centres have always been more beautiful with a far higher build quality than any of WeWorks offices. Now that’s it’s a landlord play, you have a avalanche of landlords with far a deeper understanding of interior design and office fit outs than WeWork will ever be able to outsource.

- The Co-working side of the Serviced Office industry is not at all profitable. Nobody makes money from co-working. Most operators provide a little co-working alongside a largely 3/6 person partitioned multi-office layout or around dead spaces. WeWork took out entire floors and dedicated it to open-plan co-working.

- How did this even begin? The earliest shareholders including a gentleman called Mortimer Zuckerman were not just their landlords AND seed investors. They also happened to own Fast Company and NY Daily News which were instrumental in propping up WeWork in the press before anybody knew who they were. The headlines they spun about WeWork’s valuation and ‘meteoric’ rise was basically the shareholders advertising their investments. Even Wikipedia’s page (throughout 2015 and 2016) introduced WeWork as the ‘most innovative company of 2015’, citing a Fast Company article.

- WeWork even thought about setting up WeCafe’s, they want to be the first ever to disrupt the ‘working-in-a-coffee shop-as a-service-space’. An internal report revealed people are working at spacious, trendy hipster designed coffee shops where they get not just a free table but also a chair (and free wifi) all for the price of a cup of tea. If WeWork charged their members a fraction of the market rate, half will vanish overnight. Or put another way, when they want to start becoming profitable and all the freebies come to an end it will feel like s rug has been pulled from under WeWork’s feet, by which time Adam & Miguel will be long gone.

- WeWork doesn’t pay the appropriate property taxes due on their UK based centre’s. If you look at their Business Rates schedules of the respective boroughs in which they operate in (available online) you’ll notice that split their entire space into tiny cubicles. By doing so WeWork avoids paying property taxes and earns tax rebates originally intended for small businesses, $2.4 million to date. So they’re effectively being financed by Her Majesty’s Government & the UK taxpayer too.

- WeWork spends more on PR than anything else. They are carefully written with the subtle intention of building an impression that the company is a roaring success, they pay for many of these articles. Some are even co-written by WeWork’s PR team. Every month they pay these new breed of digital financial news tabloids like Fast Company to write sensational headlines like ‘The Rise of WeWork’ & ‘How WeWork become a $47bn company’.

- If you are not already acutely aware that Adam Neumann and Miguel McKelvey are fraudsters, count the number of times the word ‘Hustle’ is plastered in neon lights at every one of their tacky ikea-designed offices (or just google the words: wework hustle and click on images).When asked whether how they could come up with a $47 billion dollar valuation, he replied ‘”No one is investing in a co-working company worth $20 billion. That doesn’t exist. Our valuation and size today are much more based on our energy and spirituality than it is on a multiple of revenue.”. When Miguel was asked about their $20 billion valuation (before it was almost tripled to $47bn), Miguel McKelvey answered ‘Who gives a s***?’.

- There are many people out there who give discreetly to charity, some give generously but only with the fanfare, some ‘pledge’ to be charitable largely for the PR impact but have no intention of giving, this is something new. Adam, his wife Rebekah & Miguel have ‘pledged’ to give $1 billion they don’t have and yet to swindle out of WeWork (not the last billion, the next billion) so they can acquire more land to help mankind and support environmental causes ‘close to their heart’. Is this the twilight zone? Where did the first billion go? Why do they feel the need to use meaningless philanthropic pledges to make themselves appear to be good wholesome folk, generous not greedy. WeWork’s cleaners have twice protested over wages. Everything is fake.

WeWork will never ever, in its short history, generate a profit, let alone the tens of billions in revenues necessary to generate anywhere near the $3 billion in earnings required to (even then generously) value the company at £47 billion.

A lot of people could have done what Adam Nuemann & Miguel McKelvey did, they don’t because they’re not prepared to engage in a fraud. They can play dumb all they like but when you fiddle with your financials, invent accounting principles, secretly acquire IP and double deal it for millions of dollars back to your own company, market yourselves misleadingly as a ‘technology’ play, cash out close to $1 billion and use that to acquire buildings to lease back to WeWork, employ half your family etc, etc, etc…please for heavens sake don’t try and convince me that they are unaware of what they are doing. They know exactly what they’re doing. Adam and Miguel purposefully choose to hide those costs under ‘Community-Adjusted EBITA’s’. Why are they still parading WeWork as a technology company, does anybody believe as cunningly intelligent as they are, that they genuinely think WeWork is a ‘technology’ company? Why have they cashed out, and not just a few million dollars as a deposit on a big mortgage but hundreds of millions to buy buildings that they used to further bleed their own ponzi scheme with?. They have cashed out $1 billion whilst posting losses of $1.9 billion.

Since their S1 release, Adam & Miguel have slashed their proposed post-IPO valuation by 86% in 4 re-valuations. The price started at $67 billion, then they quickly dropped it to $30/$40bn before again looking down at their calculator and punching buttons quicker than you can blink and coming back with $15/20bn. As you’re about to click, it plunges 40% to $10bn. From $67 billion to $10 billion in 7 days. It’s pathetic seeing this kind of desperation. I don’t want to be in the room when he realises it’s not even close to being worth anywhere near $1 billion. Within the last 10 days or so, his wife Rebekah has also removed from her extraordinarily unnecessary position, they’ve hastily elected their first female to their Board, halved Adam’s voting power, lost a Chief Communications Officer, their bonds are crashing, two landlords have begun legal proceedings, their principle investor Masayoshi has publicly called for Adam to delay the IPO, even Alexandria Ocasio-Cortez weighed in and warned vulnerable investors Goldman Sachs & JP Morgan are now targeting… ‘you’re getting fleeced!’. It’s not all bad news though, Adam agreed to return the $6m he swindled when he secretly sold ‘We’ back to his company The ‘We’ Company. Btw, if you’re wondering why he settled on the name. ‘We’ he pontificated recently ‘The ‘90s and early 2000s were the i decades. iPhone, iPads, the iPod – everything was about me. Look where that got us? In a terrible recession’.

To wrap up, if you were to contrast the key characteristics of what defines a ponzi scheme with what we already know about WeWork, I think we could safely assume beyond a reasonable doubt that WeWork is a fraud, both Miguel McKelvey and Adam Neumann seem to be knowingly engaging in a fraudulent ponzi-like scheme designed to mislead investors and they appear to be nothing more than your average, traditional, run of the mill fraudsters, or in their own words….’Hustler’s’. The magnitude of this fraud and the unprecedented arrogance in which it’s being ruthlessly executed puts it in a league of its own. Now they’re hoping to hustle the big boys on Wall Street, and they will most likely get away with it.

The most discomforting element of this whole deception is that after perpetuating this fraud for so long, media outlets are now inviting these Hustlers to media-sponsored ‘leadership’ events where they’re put on podiums to teach us how to become visionary’s whilst they have now made it unnecessarily more difficult for genuine entrepreneurs & technology companies to raise capital in future. The future is farther because of them.

Note: Thank you for all your comments, very much appreciated. This is the first article I’ve ever written (and only because its beyond anything I have ever come across and it made me cross). Apologies for the grammar, punctuation and lack of citations, you should be able to find most if not all of the points made above by searching relevant keywords on Google. I learnt the majority of the above from the exceptionally brave journalists at the FT, Bloomberg, Wall Street Journal and The Real Deal who broke these stories.

This doesn’t exactly inspire confidence in WeWork’s (otherwise known as “the We Company”) upcoming IPO.

An investigation by the Wall Street Journal has determined that WeWork co-founder Adam Neumann has cashed out more than $700 million from the company using a mix of stock sales and debt.

If that number seems unusually large, that’s because it is: CEOs typically wait for their company to go public before cashing out. And though WeWork is still private and doesn’t publicize sales of stock by insiders, WSJ’s reporters believe that Neumann’s cash-out is one of the largest on record for a tech unicorn headed for a public offering.

Neumann remains the CEO of WeWork as well as its single largest shareholder, but the exact size of his holdings in the company now is unknown. As of the end of 2017, a company that controlled Neumann’s and his co-founder’s stake in the company showed they held a combined 30% of the company, which was recently valued at $47 billion during its latest round of investment in January. The company plans on moving ahead with the listing later this year or early next year, and initially filed confidentially for an IPO late last year.

Of course, such a large cash-out raises questions about the CEO’s confidence in the company and calls the lofty valuation for the cash-burning machine that is WeWork into question – particularly given the vulnerabilities built-in to the company’s business model that have been highlighted by skeptics. Like Lyft and Uber before it, WeWork’s losses have doubled alongside its revenues.

Since WeWork was founded nine years ago, Neumann has invested heavily in real estate. He spent more than $80 million for at least five homes and his other investments include commercial properties and stakes in start ups. He has also given away more than $100 million, according to people familiar with his finances.

It’s extremely rare for a private company to publicize a top executive selling stock prior to an IPO. But among the instances that are well known, Neumann’s transactions rank among the largest in dollar terms.

Neumann, who is 40 years old, has sold shares during most investment rounds since 2014 – though he didn’t take money out during the January round. He is also taking out loans of several hundred million dollars backed by his shares. On the other hand, he has used some of the proceeds to purchase more shares by exercising stock options early, a sign that he’s also betting on shares to move higher. As Neumann has pulled money out, holders of junk bonds issued by the company have gotten hammered.

The majority of Neumann’s wealth remains connected to the company. JP Morgan has been the bank helping him borrow against his shares and the bank has separately been working with the company to structure a debt deal that would raise as much as $3 billion to $4 billion ahead of its IPO.

Venture capitalists have been skeptical of pre-IPO sales by executives. Most investors would prefer that insiders keep their wealth tied to the company until it goes public so as to keep their interests totally aligned. But how was Neumann able to pull off such a massive cash-out? Though he was speaking generally and not specifically about Neumann and WeWork, Bill Gurley, a partner at WeWork investor Benchmark, said: “…the practice is driven by investors who come in at the late stage and they beg the founders to take liquidity because they’re trying to get more ownership.”

On the other hand, it isn’t 100% unheard of for founders to sell small chunks of the their shares in very late stage financing deals.

“Over the last five years there’s been a growing level of comfort among the VC community to let founders sell,” said Andrea Walne, a partner at Manhattan Venture Partners.

But several of the most recent examples of founders selling prior to the IPO paint an ugly picture:

Some of the other largest publicly-known sales of stock before an IPO include Zynga Inc.founder and CEO Mark Pincus’s deal to take more than $109 million off the table before the social-gaming company’s 2011 IPO. Eric Lefkofsky, as executive chairman and co-founder of Groupon Inc., sold more than $300 million in Groupon stock before the 2011 IPO. Both deals attracted criticism at the time, particularly after the companies’ stocks later traded at lower valuations.

More recently, Snap Inc. disclosed that co-founder Evan Spiegel sold roughly $8 million in stock and borrowed $20 million from the company before its 2017 IPO. Slack Technologies Inc. disclosed CEO Stewart Butterfield sold $3.2 million of stock between September 2016 and Slack’s June public listing.

Since 2013, Newman has bought four homes in and around New York City and paid $21 million for a 13,000 square-foot house in the Bay Area that has a guitar shaped room.

Some savvy real-estate investors are already sounding the alarm about Neumann and WeWork.

WeWork’s co-founder/CEO Adam Neumann has cashed out at least $700 million through stock and debt ahead of a possible IPO

An eyebrow-raiser from @eliotwb @maureenmfarrell @PreetaTweets https://www.wsj.com/articles/wework-co-founder-has-cashed-out-at-least-700-million-from-the-company-11563481395 …

But one doesn’t exactly need to be a genius to figure out that Neumann is essentially a con artist. He has raided his own company’s coffers by buying properties and leasing them to WeWork. He has also used the company’s money to support a private elementary school for his own kid. Don’t let the company’s PR machine – which has sought to portray Neumann as a workaholic savant – fool you.

Then again, if one “community adjusts” Adam Neumann’s cash out (the company’s preferred term for the financial engineering it has applied to its income statement)…

…they could determine that he’s actually putting money in to the company.

A month ago, Scott Galloway, the best-selling author, well-known tech-industry pundit, and professor of marketing at New York University’s Stern School of Business, unleashed his special kind of wit and financial weaponry on WeWork’s recent S-1 filing. Writing on his “No Mercy / No Malice” blog, Galloway said any Wall Street analyst who believes WeWork’s worth over $10 billion is “lying, stupid, or both.”

Now, a month later, following debacle after debacle proving him correct, Galloway is back to explain how “math” blew the whole WeWork IPO farce up…

So, the mother of all party crashers took a dump in the We IPO punch bowl. The crasher? Math. The autopsy will show the shelving of this IPO was death by S-1.

This was a case of immunities kicking in after the requisite SEC disclosure. As the greater fool theory has hit a wall, We will now need additional capital from the private markets, who are no longer under the influence. The firm will be forced to sell equity/issue debt at a price substantially lower than they had anticipated. A price unimaginable just 30 days ago.

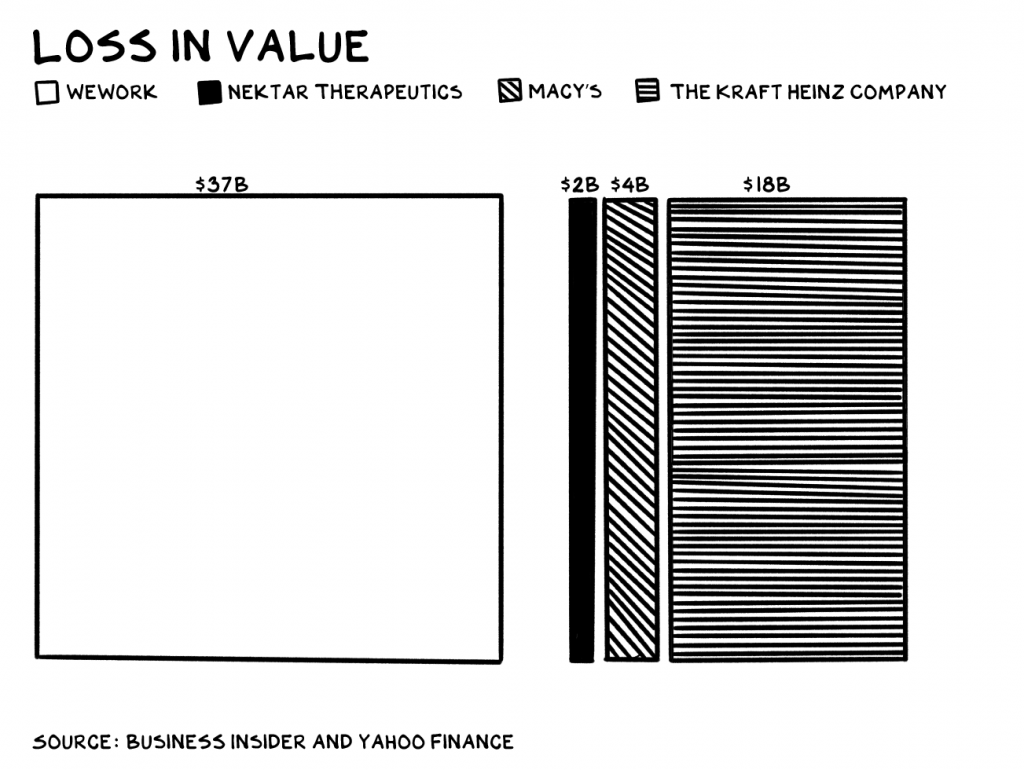

We has gone from unicorn to distressed asset in 30 days. In just seven days, We lost more value than the three biggest losers in the S&P 500 have lost in the last year combined: Macy’s, Nektar Therapeutics, and Kraft Heinz.

So, as a distressed asset, the playbook is fairly clear:

• Bring in new management. What got We here, isn’t going to get it where it needs to go. Each layer that comes off the We onion stinks more and more. The media has turned its attention to the Neumanns, and it’s as if the lights have been turned on at a cocaine-fueled party that ended several hours too late. Everyone and everything suddenly looks bad, scary even.

• The firm needs to bust a move to break even pronto. The new CEO should be from a REIT, ideally a hospitality or commercial real estate REIT. My vote is Adam Markman, CFO of Equity Commonwealth — Sam Zell’s firm.

• Shed/close all non-core businesses. WeGrow and WeLive are vanity projects. As someone close to the firm told me yesterday, they distract Mr. Neumann from the core business, where he was wreaking havoc. A $13 million investment in a firm that makes wave pools to indulge Adam’s passion for surfing. Really? Really?

• Raise money after an adult conversation with SoftBank (“You f*cked up, you trusted us. Do you want to participate in the next round or get washed out?”)

• Focus on margin expansion vs. growth. We has a differentiated product in the marketplace, and should command a premium.

• Lay off all employees not directly tied to managing the core business. Reprice options for remaining employees, as the current options are now worthless and most execs will begin looking for other jobs. The most talented (the ones with the most options) will be the first to leave if they aren’t given substantial economics for staying in Saigon as the North Vietnamese roll into town.

• 3-5 new independent directors. Boards have their own dynamic, irrespective of the qualities of the individuals. The members of this board have formidable experience/CVs. Lew Frankfort (Director) is a first-ballot Hall of Fame retail exec, and he doesn’t strike me as the type of guy who’d be bullied by the CEO, or anybody else for that matter. Again, I just can’t figure out what the f*ck happened here. Who is the head of the audit committee, and was he (they were all dudes until last week) the one passing out MDMA before each audit meeting? Or, as a private firm, did they even have audit committee meetings? This is a board that approved a $13 million acquisition of a wave pool company. Or did they?

The directors enabled an information pyramid scheme and indulged Adam, in exchange for hoping they could create enough valuation momentum, via nine rounds, to carry their shares to an exit in the public markets.

• SoftBank was reportedly considering propping up the IPO with $750 million in share purchases at the offering price. If that’s the case, shouldn’t they want to invest billions more at the now low-low 80%-off price? Or were they simply looking to pump and dump?

The above likely won’t happen. Why? As I said two weeks ago, the lines between vision, bullsh*t, and fraud are pretty narrow. I can’t wrap my head around what’s gone on here. Something is wrong. Something stinks. Something … Just. Doesn’t. Add. Up.

It’s beginning to smell like malfeasance at We. The lines between vision, bullsh*t, and fraud have been crossed here. To be clear, I’m not a journalist, nor a forensic accountant. This is pure speculation based on my experience as a CEO, investor, and director. Something is very, very wrong here. In no specific order:

• The board’s willingness to sell shares at 75% off (after seven days) says insiders knew the firm desperately needed money, and the price they advertised seven days before was not a real number (see above: malfeasance).

• Cult of personality firms seem especially vulnerable to massive declines in value or fraud. If you had to pick an analog for Adam Neumann (young, charismatic, visionary, with an outsized view of himself and a delusional view of the firm’s role in society), surrounded by gravitas/old white guys, who/what is more fitting than Elizabeth Holmes/Theranos?

• At the most recent all-hands (after the shelving of the IPO), Adam refused to take questions. Mr. Neumann is a narcissist, and to not indulge in a chance to spread more Adam means he’s now being advised by lawyers (“stick to your talking points, don’t say anything else, don’t take questions”). A bad sign.

If you liked the Theranos documentary The Inventor: Out for Blood in Silicon Valley, you’ll love Community-Based EBITDA: The Story of We, coming soon to Hulu.

At some point, tech’s gestalt of overpromise and underdeliver can paint founders into a corner where they begin massaging numbers (Earnings Before Gluten). I can relate to this. In ’99 I raised money from Howard Schultz (SBUX), Goldman Sachs, JPM, and a bevy of high-profile business people for an e-commerce incubator, Brand Farm. The company made no sense. But it was ’99, and a guy with some success, a good rap, and a shaved head could raise tens, if not hundreds of millions. My investors were nothing but supportive.

Bottom line, I didn’t have the courage/stomach to try to raise a B round, and I shut Brand Farm down. I was going to need to go “large” and spin our way to a $100 million round, and there was interest. But I was having trouble sleeping. When I get stressed, I stop eating. The correct diagnosis of my ailment was common sense mixed with a conscience. We’s mission to “elevate our consciousness” is sounding more apt with each WSJ story (some great reporting).

In sum, I can see how one gets in too deep and begins believing his or her own bullsh*t, almost as a defense/coping mechanism. I speak from experience: if you tell a thirty-something dude he’s Jesus Christ, he’s inclined to believe you.

We has consistently been so far off on any forecasts in their original pitch deck that it appears numbers are more of a nuisance than reporting metrics. Their forecasted profits: $14 million for 2014, $64 million for 2015, $237 million for 2016, $542 million for 2017, and (wait for it) $1 billion for 2018.

Except in 2018 the firm lost $1.6 billion, which is likely understated. SoftBank is the only investor since 2016, a rookie move in the world of investing. The lack of external, third-party validation can lead to everyone smoking their own supply, and more poor governance. Henry Hawksberry (pen name I think) wrote a blistering piece on Medium alleging, among other things, We was paying brokers 100% commissions, then figuring out how to turn expenses into revenues and pulling forward billables. If half of this is true, it’s fraud.

Ok, the wolves are closing in. What to do? I know, we’ll provide an exclusive to a network that throws us softball questions and provides a veneer of legitimacy. CNBC, that’s the ticket. We’ll distract from the boring stuff, like numbers, and bring with us early tech investor Ashton Kutcher. The third and and a half man is masterful and, sitting next to Adam, raptures:

“I realised it was a technology company. I also realised that this company, through its technology, has greater capacity than any other company in the entire world to bring people together.” Really, Ashton, really? Aren’t misleading metrics and nomenclature just non-carbonated fraud?

Why. Would. They. Leave?

The two most senior corporate communications exes, Jennifer Skyler and Dominic McMullan, both left recently, right before the IPO. Ok, so think about that. You are the belles of the ball of a firm about to IPO at $50 billion, and (in the case of Dominic) you announce, weeks before the IPO, “After becoming a dad (twice) in recent years, I’ve decided to take time off to spend with family in Brooklyn for now.” Yep, that makes sense. You know us men, always leaving right before the IPO to spend more time with our families.

The head of comms, Jennifer Skyler, left a few weeks ago for AMEX. Uh huh, that makes even more sense. Who wouldn’t want to bolt from the second-most-anticipated IPO of the year to go flack about the new American Express Marriott Bonvoy Brilliant Card. What’s worse than spending all day every day at home with two baby boys or downtown at AMEX? Engaging in fraud.

How did this happen?

A frothy market coupled with our gross idolatry of innovators creates an ecosystem that enables incremental disingenuous acts such that, if We had gotten public and managed to spend their way out of this hole, they might be lauded as “visionary.” What if Ms. Holmes had been able to raise another $2 billion and the technology had begun to show promise? Wouldn’t she be on Oprah and CNBC, instead of HBO?

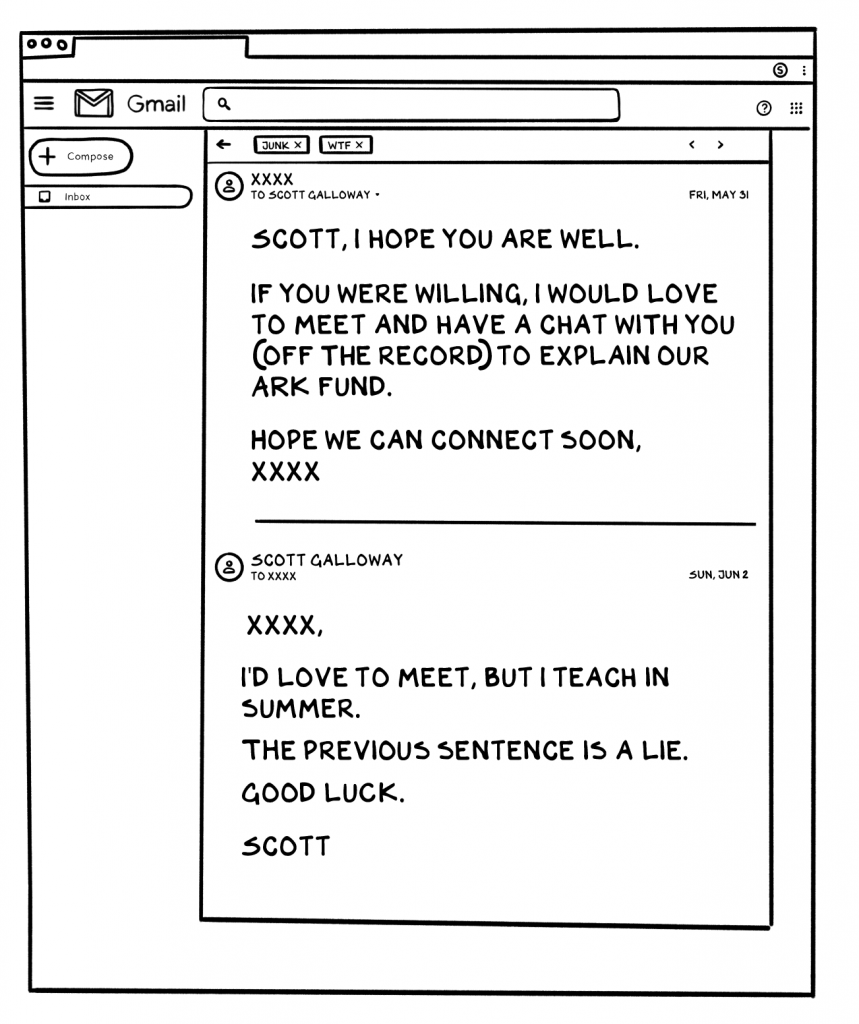

We’ve witnessed a halving of journalists since 2008, while the number of corporate communications execs has tripled. In sum, the ratio of bullshit/spin to watchdogs has increased sixfold. In the last 24 hours, I’ve been contacted by the BBC, WSJ, and WaPo to comment on We. But before any press outlet contacted me, I heard from a senior comms person at We, after I mentioned on Pivot in January that WeWork will be in the news a lot in 2019, for all the wrong reasons. Below is an email exchange I had with them in May. The subject was “Whipping Boy.”

As a general rule, I return the call of every journalist and refuse to meet with any corporate communications exec.

The halcyon of the markets coupled with feckless regulatory bodies and the decimation of investigative journalism has made the markets ripe for fraud. We is falling off the tree.

Predictions:

- In the next 30 days, a series of explosive investigative journalism pieces will document breathtaking malfeasance at We.

- In the next 60 days, a state attorney general, SEC, or other regulatory body will launch a formal investigations into We.

- Over the next 12 months, SoftBank’s Vision Fund will be shuttered.

To get involved in WeWork alternatives, visit www.preiposwap.com

For an alternative view on markets, see Global Intel Hub