Joining a deluge of private unicorns such as Lyft, Pinterest, and Uber rushing to access public capital markets while the S&P remains at all time highs, on Friday morning Slack Technologies became the latest Silicon Valley darling to go public, or rather “public”, because unlike most of its peers, instead of filing to go public via an initial public offering, Slack filed an application for a Direct Listing, giving potential public investors their first look at the financial information behind the transformative messaging-platform company.

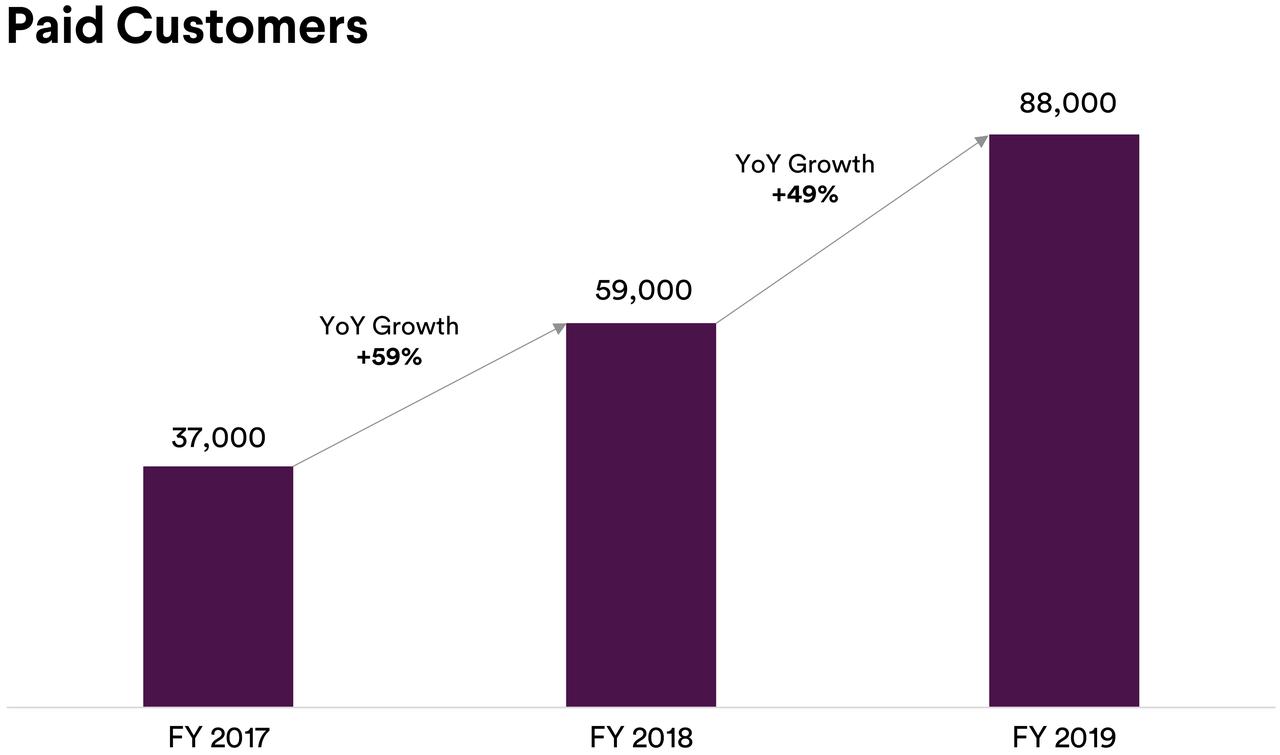

First, some background: Slack’s main product – software for workplace chat and collaboration – debuted in 2013 and now has more than 10 million daily active users according to the filing, which adds that about 3 million users pay to use the service, translating into 88,000 actual paying customers, a 49% increase from the prior year.

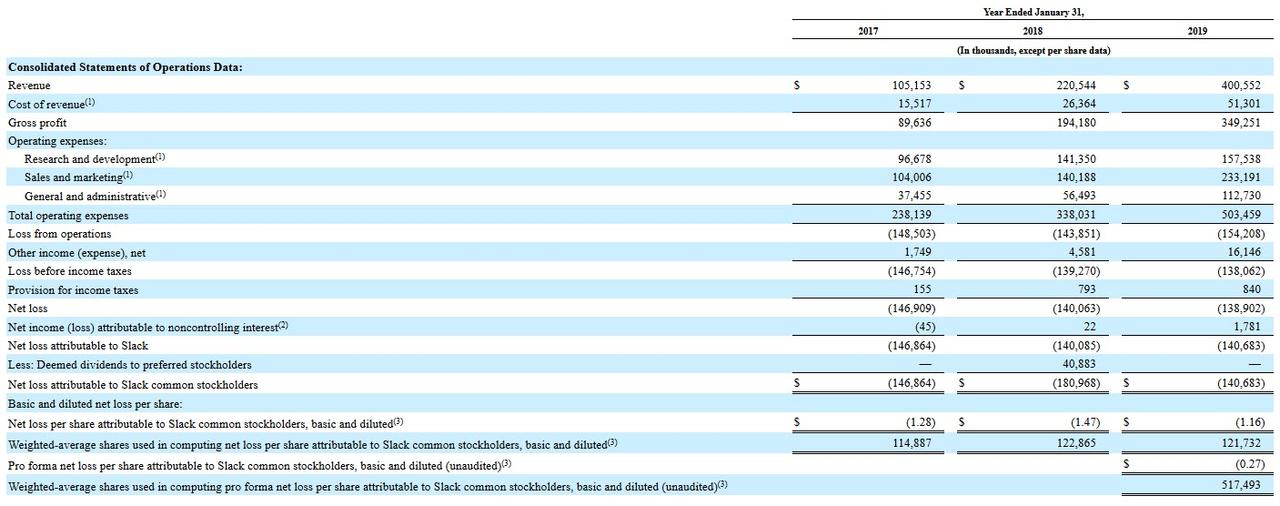

Not surprisingly, like its peers Slack does not generate a profit, and in the fiscal year ended Jan 31, 2019, the company reported a net loss of $139 million…

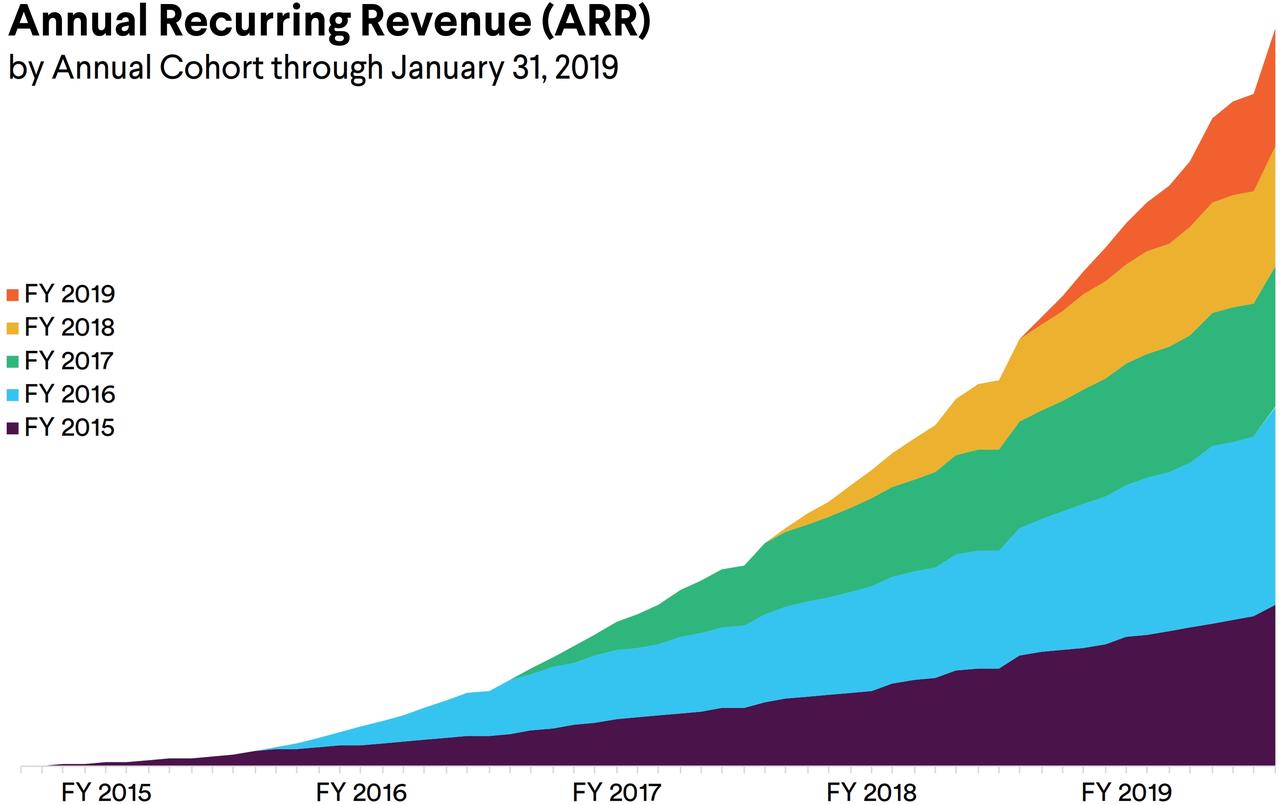

… on revenue of $401 million for the same period, much of which is recurring.

Some more details from the filing, via Bloomberg:

- Full-Year 19 Rev. $400.6M, up from $220.5M

- Full-Year 19 Loss From Ops $154.2M, up from $143.9M

- More than 88,000 paid customers as of Jan.31, including more than 65 companies in the Fortune 100

- Daily active users exceed 10 million in three months ended Jan.31

- Sees increasing operating expenses in the future, and may not be able to achieve and, if achieved, maintain profitability, according to risk factors

In terms of valuation, the sales of the stock on the secondary market have recently valued the company at around $16 billion, more than twice the most recent private valuation, with the company’s Class B High Sale Price in FY19 rising to $23.41 from a Low Price of $8.37 in 2019. Incidentally, less than a year ago, last August, Slack raised $425 million in a transaction which valued the company at $7.1 billion, or roughly half its current tentative valuation.

Perhaps in a preview of its Direct Listing, Slack has allowed many more secondary sales in recent months in order to test what public investors might be willing to pay. As Bloomberg reports, investors were buying its shares on the secondary market recently at up to $26 each. That’s double the price from several months ago, when those same shares sold for $11.91 in September.

What is most notable about the transaction is that as noted above, Slack has picked a direct listing rather than a traditional IPO, and in doing so it is following in the footsteps of Spotify, which went public last year by the same method. And since there will be no IPO, and thus no underwriters, instead Slack will simply use advisers Morgan Stanley, Goldman Sachs and Allen & Co. to research a fair price for the stock to open for trading in May. That said, Slack has picked Morgan Stanley to advise market maker Citadel on the Slack direct listing. This means it will determine the price and share count to begin selling the stock.

Which brings us to the key question: why use a Direct Listing instead of an IPO. Several reasons:

- First, companies that opt for a Direct Listing are generally those that don’t need more publicity or a new influx of cash. As Bloomberg notes, “Slack is well known among office workers who use its product, and CEO Stewart Butterfield has said the company has in the bank plenty of the $1.2 billion it has raised.” As for cash, in the past few years, private capital has been very easy to come by for technology startups, and as a result many of them no longer go public just to raise cash, but they want to give their employees and early investors a liquidity event. The direct listing is a nice way to create a public company and give workers liquidity without the fanfare of an IPO.

- Second, because a direct listing doesn’t create new shares, current owners don’t deal with fresh dilution.

- Third, and most important, big investors have a far more liquid market in which to sell. And as Bloomberg notes, affiliates are restricted from selling shares for just 90 days after Slack becomes a reporting company, according to the filing. All other holders can sell right away, as long as they’ve owned their stake for at least a year. Meanwhile, IPOs typically carry a 180-day lockup period for insiders and pre-IPO shareholders.

In other words, the whole point of the Direct Listing is to allow large holders the opportunity to get out faster after the stock begins trading.

So who are these lucky investors who will now be dumping to the general public as fast as they can?

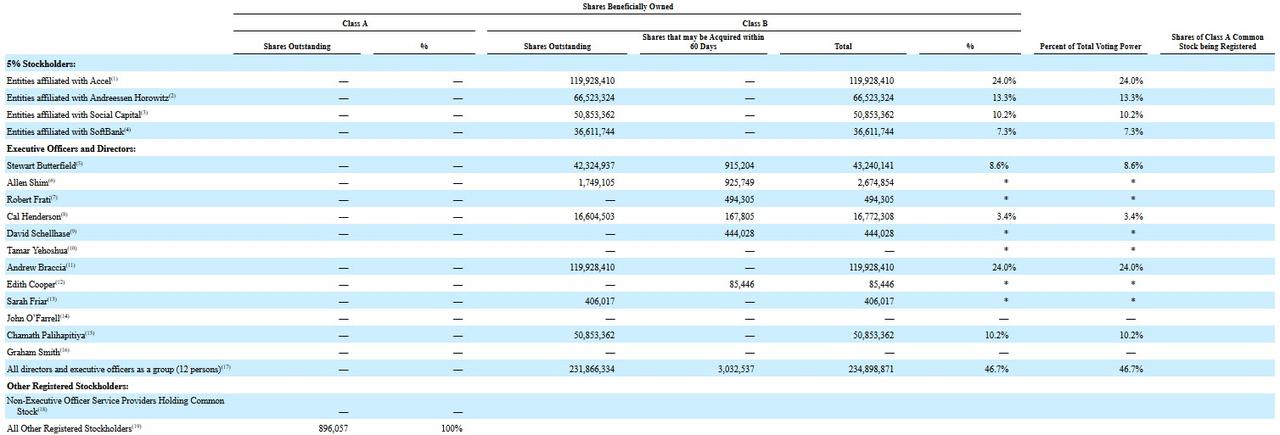

According to the filing, Slack’s biggest stockholder is venture capital firm Accel, which holds 24% of the outstanding shares. Next is venture firm Andreessen Horowitz, with about 13%, the Social Capital, and SoftBank Group. Among its executives, Slack’s co-founder and chief executive officer Stewart Butterfield holds 8.6%; he will be the last member of the “tres commas” club once the stock starts its public trading. Finally, co-founder and chief technology officer Cal Henderson holds 3.4%.

To summarize: Slack does not need the money, nor the prestige, nor price targets to boost employee egos associated with going public; instead what it needs is a broader, more liquid market into which insiders can dump their shares, which with every other unicorn rushing to IPO and toptick the market, we are confident that’s precisely what they will be doing.

SIGN UP